Job Growth & Unemployment

Posted on 03/14/2017 by Beverly Kerr

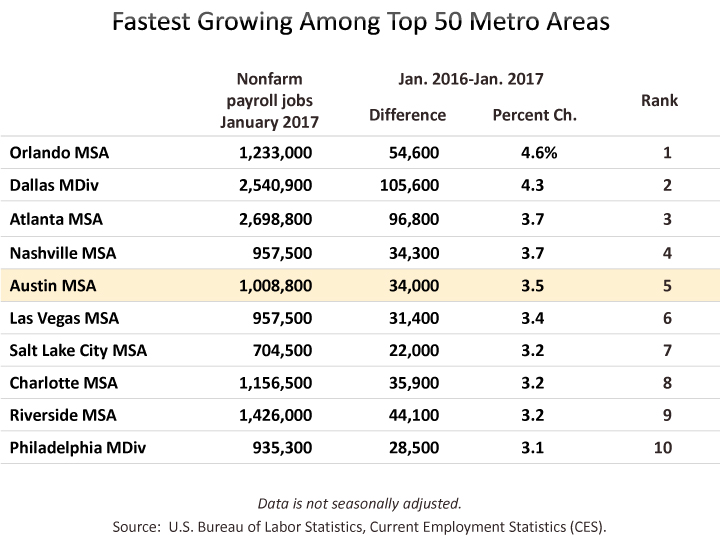

- Austin added 34,000 net new jobs, growth of 3.5%, in the 12 months ending in January, making Austin the fifth fastest growing major metro.

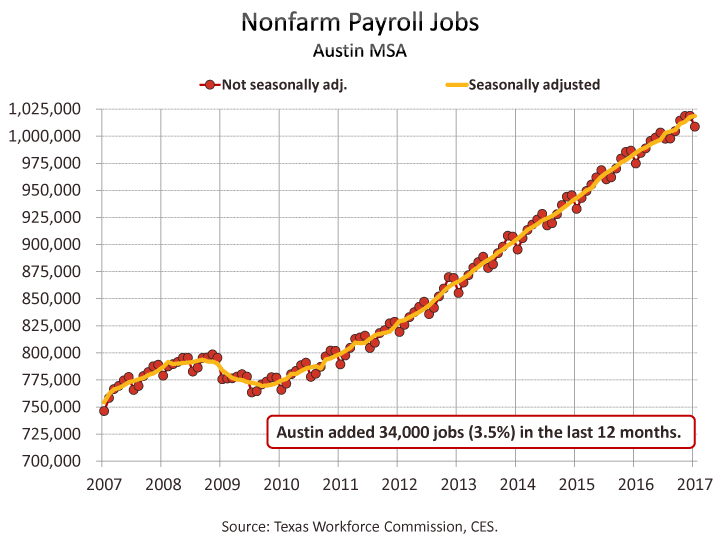

- Job growth in Austin in 2016 was more robust than the preliminary estimates indicated. Growth for the 12 months ending in December, previously estimated at 1.9%, was boosted to 3.3% following annual benchmark revisions completed in March.

- Austin's seasonally adjusted unemployment rate is 3.4%, unchanged from December. The rate was 3.2% one year ago.

The Austin metropolitan area added 34,000 net new jobs, or 3.5%, in the 12 months ending in January, according to the latest releases of preliminary payroll jobs numbers by the Texas Workforce Commission (TWC) and the U.S. Bureau of Labor Statistics (BLS). Austin’s 3.5% growth makes it the fifth best performing among the 50 largest metro areas. Dallas (4.3%) ranked second while the other three major Texas metros missed the top 10. Fort Worth grew by 3.0% (12th), San Antonio grew by 2.6% (20th) , and Houston grew by 0.3% (48th) between January 2016 and January 2017.

You may recall that January’s article on job growth noted Austin’s moderating rate of growth in the second half of 2016, such that year-over-year job growth had fallen to only 1.9% in December. This compared to year-over-year job growth of over 4% earlier in the year. At that time, data through the third quarter from an alternative program, the Quarterly Census of Employment and Wages (QCEW),[1] also signaled moderating job growth compared to the previous few years, but not the degree of slowing indicated by CES. March is the occasion for the annual benchmark revision process for these Current Employment Estimates (CES). Revisions have indeed shown that Austin's growth was more robust in 2016 than preliminary estimates indicated. Growth for the year ending December 2016 was 3.3%. That is more moderate growth than the preceding four years, but considerably better than the original 1.9% estimate.

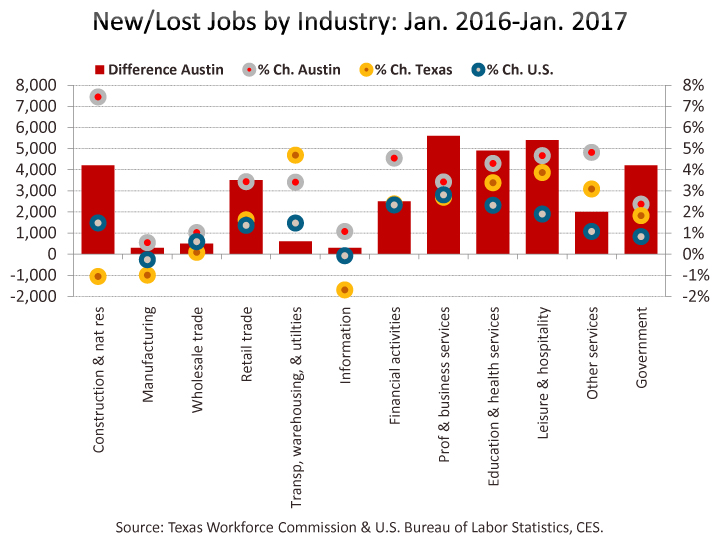

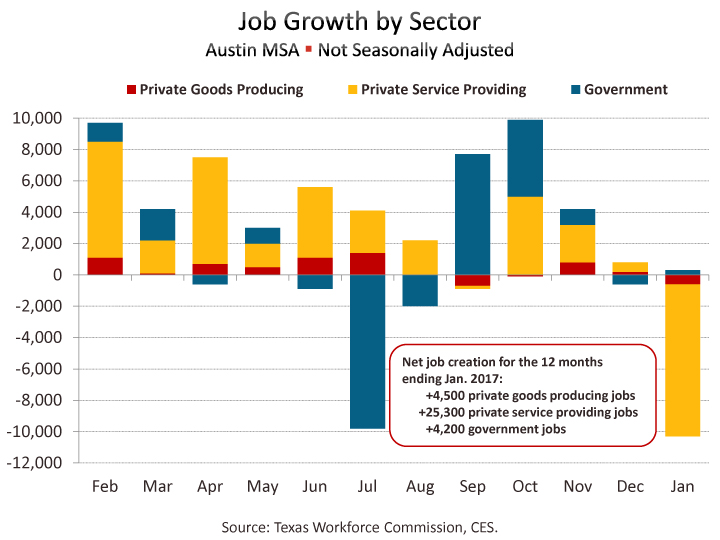

For the year ending in January, private sector job growth in the Austin MSA is 3.7%, or 29,800 jobs, and with all private industry divisions contributing to the growth. Austin's sizable government sector (nearly 18% of jobs) saw more modest growth over the last 12 months, gaining 4,200 jobs or 2.4%, thus bringing the overall job growth rate to 3.5%.

Texas saw net private sector job growth of 2.0% with all private industries, except three, adding jobs over the last 12 months. The government sector, which accounts for over 16% of total state employment, gained less, 1.8%, however, total job growth statewide was also 2.0%. For the nation, private sector growth is 1.5% for the 12 months ending in January with all private industries, but two, adding jobs. Overall job growth is a more modest 1.5% because the government sector gained only 0.8%. At this time, the most recent month of national data is February. For the 12 months ending in February, national private sector job growth is 1.8% and total job growth is 1.7%.

Jobs in January are down from the preceding month by 10,000 jobs or 1.0% in the not-seasonally-adjusted series for Austin, while on a seasonally adjusted basis, jobs are up by 1,000 or 0.1%. Seasonally adjusted jobs are also up in Dallas, Fort Worth, and San Antonio by 0.5%, 0.7%, and 0.3% respectively. Jobs are down in Houston by 0.1%. Statewide, seasonally adjusted jobs are up 51,300 or 0.4% in January. Nationally, seasonally adjusted jobs rose 0.2% in January and February.

In Austin, the industry adding the most jobs is professional and business services which grew by 5,600 jobs, or 3.4%, over the last 12 months. Construction and natural resources grew fasted at 7.4% and added 4,200 jobs. Also growing at faster-than-average rates are other services (4.8% or 2,000 jobs), leisure and hospitality (4.7% or 5,400 jobs), financial activities (4.5% or 2,500 jobs), and education and health services (4.3% or 4,900 jobs). [Click here for a series of graphs illustrating the last decade of each industry’s growth in Austin compared to the state and the nation.]

Statewide, transportation and warehousing grew fastest (4.7%). The other relatively fast growing industries were leisure and hospitality (3.9%), education and health services (3.4%), other services (3.1%), professional and business services (2.7%), and financial activities (2.4%). Jobs declined in information (1.7%), construction and natural resources (1.1%), and manufacturing (1.0%), and over the last 12 months.

Nationally, professional and business services grew fastest, adding 2.8% over the 12 months ending in January. Financial activities and education and health services and also grew at faster-than-average rates, both by 2.3%. Manufacturing and information both lost jobs, 0.3% and 0.1% respectively.

The net gain for private service-providing industries in Austin is 25,300 jobs, or 3.7%, over the last 12 months. Employment in goods producing industries is up by 4,500 jobs or 4.0%. Statewide, private service-providing industries are up 216,800 or 2.7%, but goods producing industries are down 18,300 jobs or -1.0%.

We also now have January labor force, employment, and unemployment numbers for Texas and local areas in Texas. The same data for all U.S. metros that we often do a ranking of will not be released until Friday. In December, Austin had the fifth lowest rate of unemployment among the 50 largest metros.

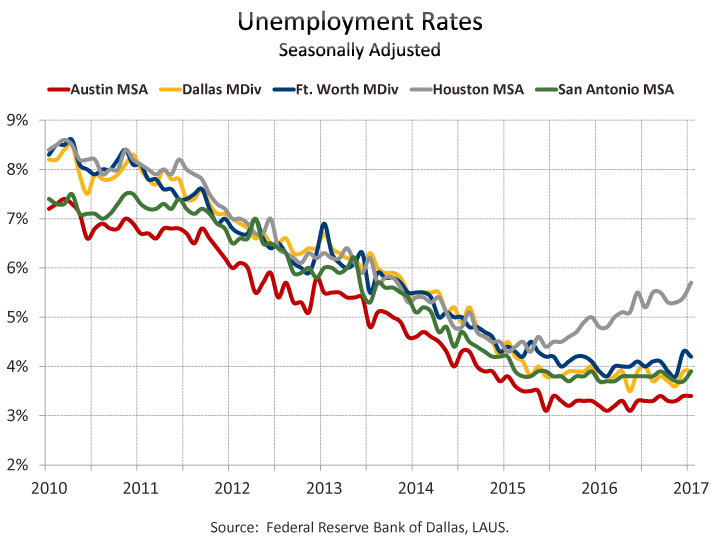

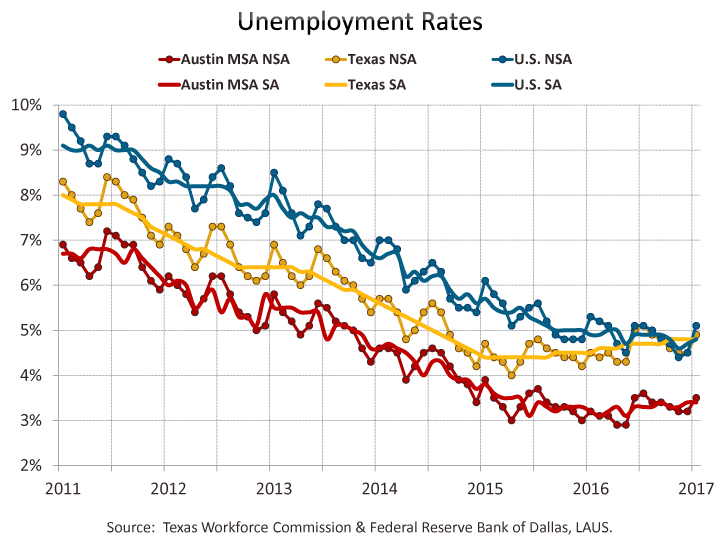

Unemployment numbers for January show Austin’s performance relative to the state and other major Texas metros being sustained. In January, Austin is at 3.3%, while the other major metros range from 3.9% in San Antonio to 5.8% in Houston. Dallas and Fort Worth are at 4.0% and 4.2% respectively. Austin’s rate one year ago was 3.2%. The rates in Texas’ other major metros are up from the rates seen a year ago. The statewide not-seasonally-adjusted rate is now 4.9%, up from 4.5% in January of last year. The latest national data is for February and the U.S. unemployment rate is 4.9%, compared to 5.2% in February 2016.

Within the Austin MSA, Travis County has the lowest unemployment rate in January, at 3.3%, while Caldwell County has the highest at 4.3%. The rate is 3.5% in Hays County, 3.7% in Williamson County, and 3.9% in Bastrop County.

On a seasonally adjusted basis, Austin’s January unemployment rate is 3.4%, unchanged from December. Rates have been 3.4% or lower since June 2015. Austin has not seen unemployment this low since early 2001, before the “dot-com” recession. The statewide rate is 4.8%, unchanged from December. Nationally, the seasonally adjusted unemployment rate is 4.7% in February, improved from 4.8% in January.

Among Texas major metros, Dallas and San Antonio have the next lowest seasonally adjusted rate at 3.9%, while Fort Worth and Houston are at 4.2% and 5.7% respectively. January rates are down from December in Fort Worth, up in Houston and San Antonio, and unchanged in Austin and Dallas. Seasonally adjusted unemployment rates for Texas metros are produced by the Federal Reserve Bank of Dallas. (The TWC also produces seasonally adjusted rates for Texas metros, but publication lags the Dallas Fed’s data.)

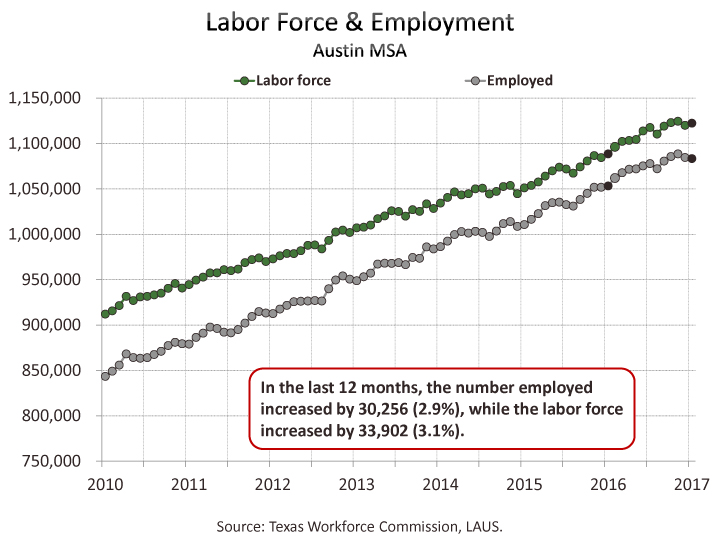

With Austin’s unemployment rate up from one year ago, the number unemployed has also increased. In January 2016, Austin’s number of unemployed was 35,328. Over the last 12 months, the unemployed have increased by 3,646 or 10.3%, to 38,974.

The Austin metro’s civilian labor force (employed plus unemployed) has increased by 3.1% or 33,902 persons from one year age, while persons employed increased by 2.9% or 30,256. Texas also saw larger growth in labor force (1.9%) than in employed (1.4%), and the number unemployed increased by 11.7%. Nationally, January civilian labor force is up by 0.8%, while employed is above the level of a year ago by 1.0%, and 160,000 fewer people (1.9%) are unemployed.

Texas Workforce Commission will release February estimates on March 24.

FOOTNOTES:

[1] QCEW is a key input to the annual benchmark revision of the CES sample survey estimates. QCEW is based on administrative records for workers covered by state and federal unemployment insurance. CES estimates include these workers as well as supplemental estimates for some industries that have workers that are not covered by unemployment insurance.

Related Categories: Central Texas Economy in Perspective