Venture Capital

Posted on 02/07/2019 by Beverly Kerr

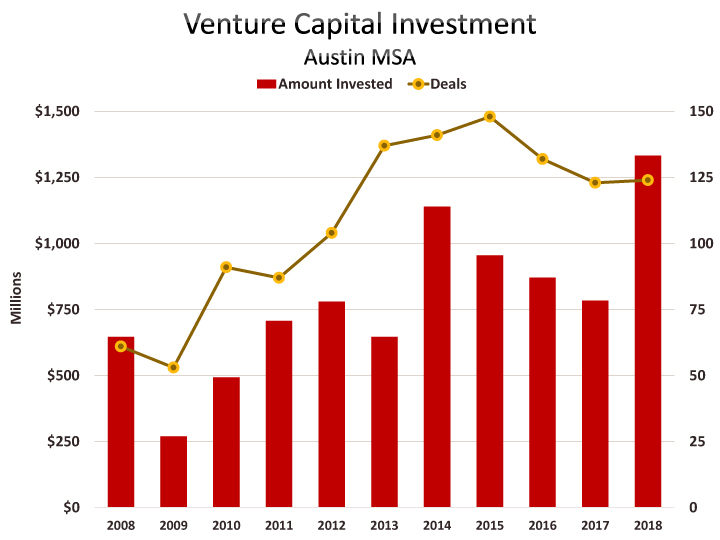

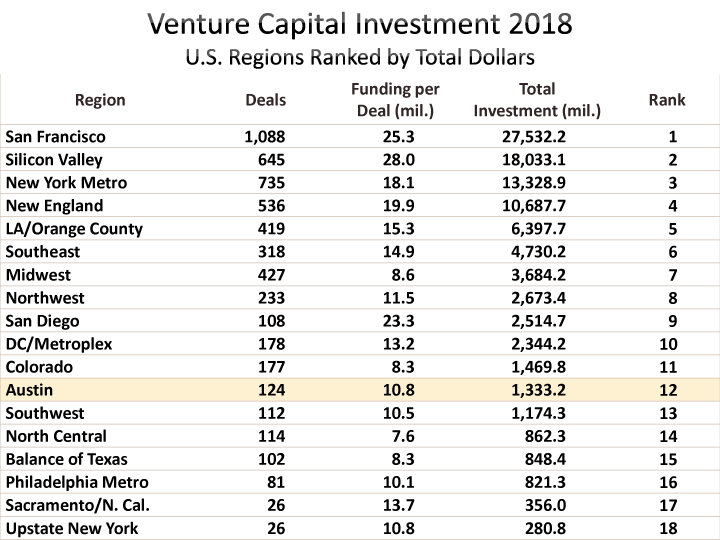

- Venture capital funding invested in 124 Austin companies in 2018 totaled over $1,333 million, up 70% over 2017.

- Average investment per deal was $10.75 million in Austin, up from $6.37 million in 2017.

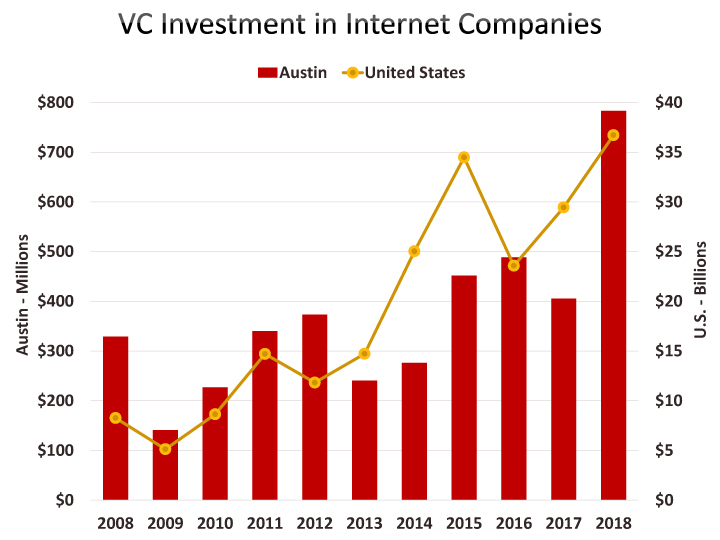

- Internet companies dominated VC investing in Austin, taking 59% of funding in 2018, compared to 37% nationally.

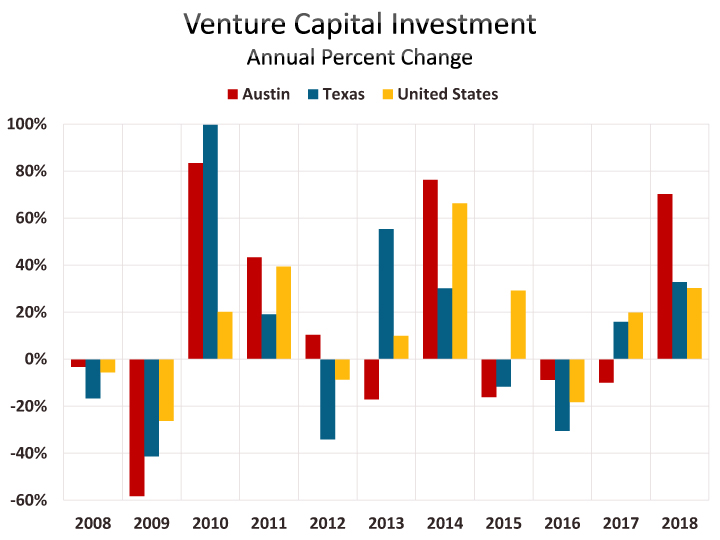

Austin companies attracted $1,333.23 million in venture capital (VC) investment 2018. That is 70.2% higher than 2017 ($783.38 million) and 51.7% above average annual investment over the previous five years ($879.04 million). Nationally, VC investment was up 30.3% in 2018 over 2017 and 57.9% over the annual average for 2013-2017. In Austin, and nationally, only 2000, the year before the dot-com bubble burst, saw a higher level of funding.

What follows examines 2018 and trends over the last decade based on recently released year-end data from the The PwC MoneyTree™ Report by PricewaterhouseCoopers and CB Insights.[1] It should be noted that, just weeks into the year, Austin’s strong performance in 2018 appears to be continuing into 2019. In January, Austin companies including Billd, Disco, Dosh, Outdoorsy and RigUp have each seen deals of $40 million or more.[2]

Austin took the majority of VC investing in Texas in 2018—61.1%—considerably more than the 48.3% share Austin companies have seen over the previous five years.

VC investing in Texas accounted for 2.2% of total investment in 2018 and 2.9% over the preceding five years. However, the state took in 4.3% of the total over 2008-2012 and 5.7% over 2003-2007. Similarly, Austin accounts for 1.3% of VC dollars in 2018, down from 1.4% over the preceding five years, 2.0% over 2008-2012 and 2.5% over 2003-2007.

What probably most impacts both Austin’s and Texas’ contracted shares of total investment is the performance of California. California accounted for 50.4% of U.S. VC funding over 2008-2012, 52.9% over 2013-2017, and 55.2% in 2018. New York’s profile has also grown. The state accounts for 13.1% of VC funds in 2018, compared to 11.6% over 2013-2017 and 6.6% over 2008-2012.

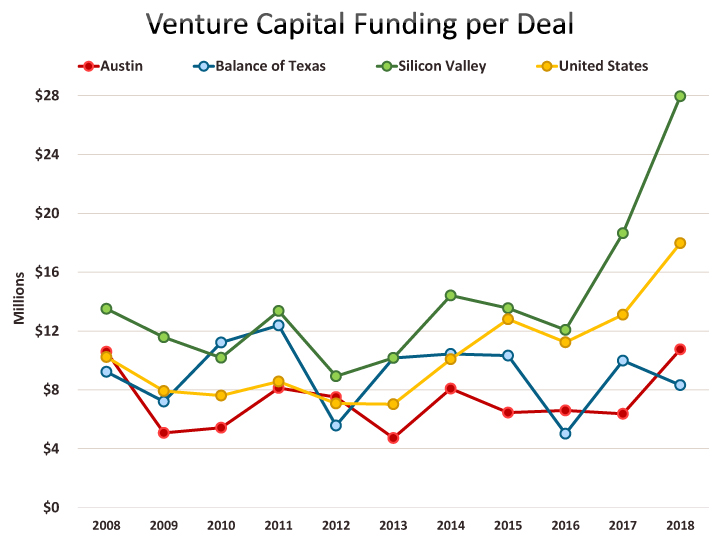

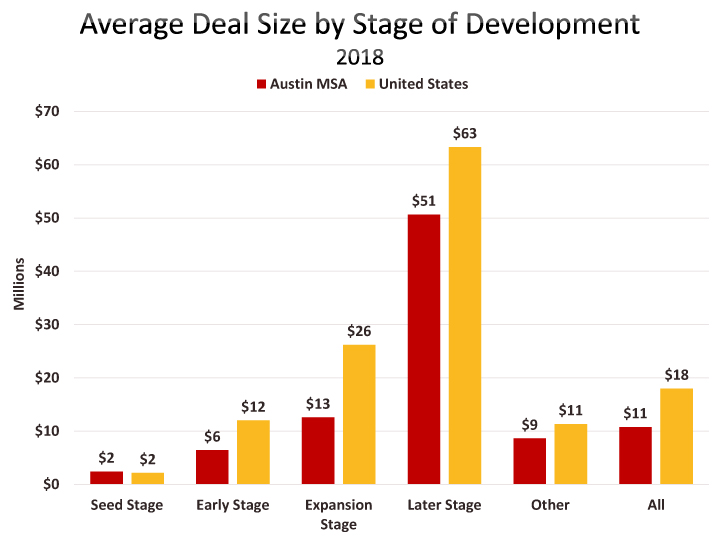

Funding per Deal

In 2018, 124 Austin companies took in an average of $10.75 million each. That level of funding per deal is higher than 2017 ($6.37), and also above the average of the previous five years ($6.45). Austin’s funding per deal in 2018 is about 60% of the national average of $17.97 million—similar to the 59% average national deal size seen over the preceding five years. However, for five years before that, 2008-2012, Austin’s average deal size was 89% of the national average.

The difference in average deal size between Austin and the nation has much to do with the extraordinary deal size levels of San Francisco ($25.31 million) and San Jose ($27.96 million) in 2018. Companies in these markets took in 46% of all funding in 2018. Average funding per U.S. deal outside of the Bay Area in 2018 was $14.18.

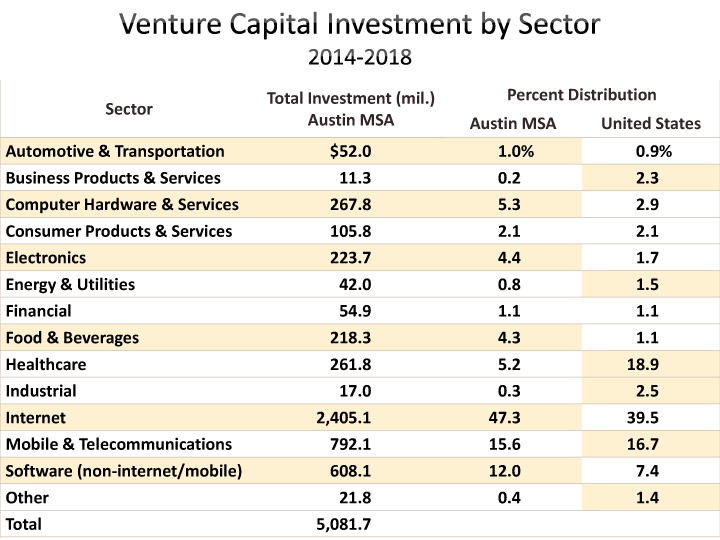

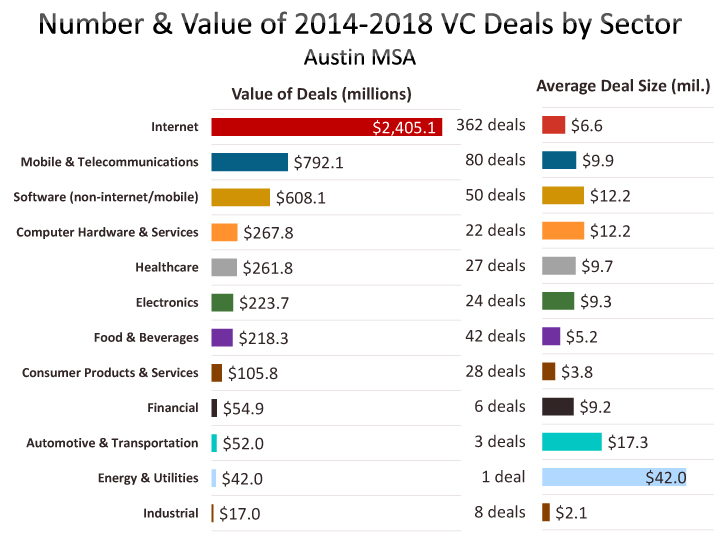

Investment by Sector

Internet companies took the majority of investments in Austin in 2018. Sixty-nine deals in this sector accounted for $783.33 million or 59% of total funding. WP Engine, which provides a managed hosting platform for website, collected $250 million in the region’s biggest deal. BigCommerce, which provides e-commerce solutions, garnered a $64 million investment. This was the second largest internet deal and the third largest deal overall in Austin in 2018.

Software (non-internet/mobile) was the second largest sector by value ($154.28) in 2018. HNI Healthcare, which provides healthcare management software, garnered $65 million in the fourth quarter following a funding of $25 million earlier in the year.

Mobile and telecommunications was 2018’s third most funded sector in Austin in 2018. Of the 11 Austin deals, Aceable ($47 million) and Dosh ($44 million) were the most significant.

Internet companies dominate VC investing nationally as well as in Austin. Over the last five years, internet companies have attracted 47% of funding in Austin and 39% of funding nationally. In Austin, funding of internet companies rose 93% in 2018. Nationally, the sector’s funding rose 20% in 2018. In 2018, funding per internet deal was $11.35 in Austin compared to $14.93 nationally. Funding per deal in 2018 was up by 85% in Austin and 30% nationally, over 2017.

Together, the five information technology-related sectors account for 91% of the value of investing in Austin companies over the last year and 81% of VC dollars over the preceding five years. Nationally, IT-related sectors account for 66% of 2018 funding and 69% of 2013-2017 funding.

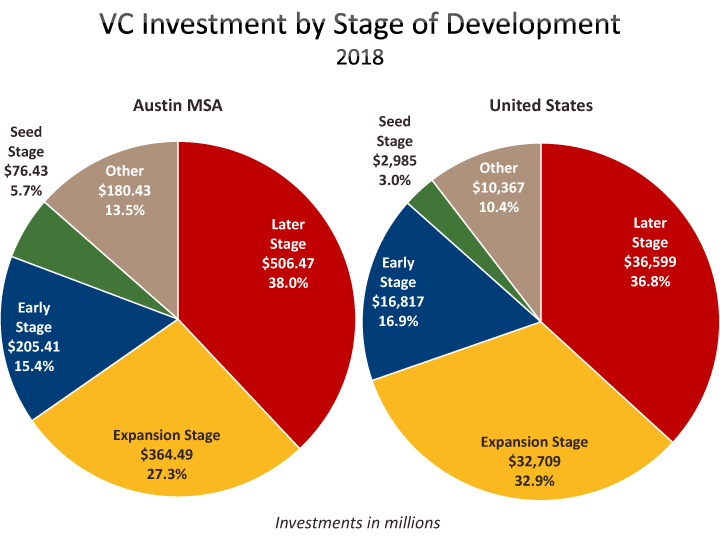

Investment by Stage of Development

Of 2018’s 124 Austin area deals, 32 are classified as seed stage, 32 are early stage, 29 are expansion stage, 10 are later stage, and 21 are “other.”

Investment in Austin companies over the last decade has been dominated by expansion stage company deals (38.4% for 2008-2017). In 2018, while investment increased over 2017 for all stages, the largest share of funding shifted from expansion stage companies to later stage companies (38.0%). The large WP Engine and BigCommerce deals, both later stage, would have been a factor in this. Over the preceding decade later stage deals accounted for 31.8% of area funding.

Seed and early stage companies accounted for 51.6% of funded companies in 2018, compared to 57.1% over the preceding five years. Dollars going to these deals accounted for 21.1% of funding in 2018, compared to 25.3% over 2013-2017. Austin’s largest seed stage deal in 2018 was a $5.85 million investment in Life by Spot, which is classified in mobile and telecommunications and provides instant short term life insurance for adventure activities. Dosh, provider of a cash-back app, and also in the mobile and telecommunications sector, garnered $44.00 million, the largest early stage deal.

Nationally, seed stage funding fell to 3.0% total funding in 2017 from the 3.7% it accounted for over the preceding five years, while early stage increased its share slightly to 16.9% from 16.4%. Expansion and later stage investing shares of total fell back slightly. Expansion stage deals accounted for 32.9% in 2018, down from 33.3% in the preceding 5 years. Later stage deals took 36.8%, down from 38.6%. Other stage deals took 10.4% of funding in 2018, up from 8.8%.

The Chamber’s Economic Indicators page provides an up-to-date historical spreadsheet of venture capital data for Austin, Texas and the U.S.

FOOTNOTES:

[1] For a detailed explanation of the investments represented in the PwC/CB Insights MoneyTree venture capital estimates, see page 98 of the PwC/CB Insights MoneyTree Report.

[2] For additional reporting on VC investing in Austin in 2018, see this January 24 article in the Austin American-Statesman and a January 10 item in the Austin Business Journal.

Related Categories: Central Texas Economy in Perspective