Business Cycle Indexes

Posted on 01/10/2018 by Beverly Kerr

- Austin’s overall economic activity is expanding at a rapid pace, gaining 7.4% in the last 12 months.

- Austin’s Business Cycle Index has risen every month since October 2009 and the rate of growth has increased each of the last 12 months.

- The Texas Leading Index and recent employment growth have lead the Dallas Fed to forecast that Texas jobs will grow 3.0% in 2018, up from 2.5% growth in 2017.

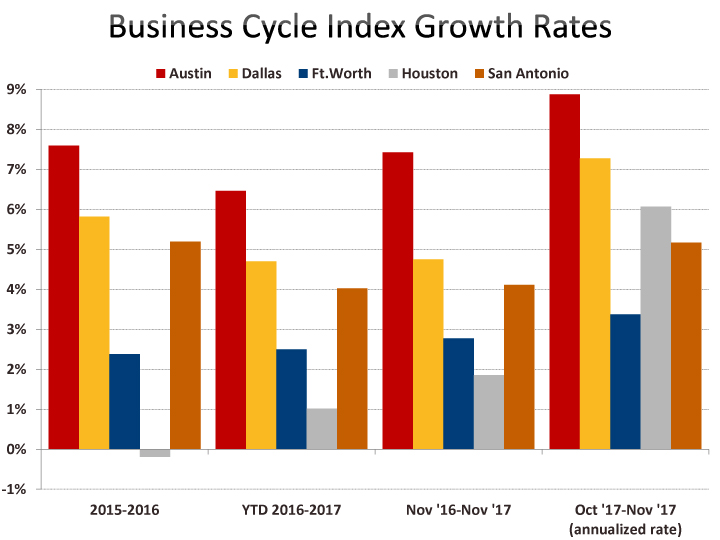

The latest update to the Federal Reserve Bank of Dallas’ Business Cycle Indexes reveals Austin’s overall economic activity is expanding at a rapid pace, gaining 7.4% in the last 12 months. Gains among Texas’ other major metros over the same period range from 1.9% in Houston to 4.8% in Dallas. Growth from October to November was 0.7%, or 8.9% at an annualized rate, also exceeding the other major Texas metros.

The Business Cycle Index summarizes movements in locally measured payroll employment, the unemployment rate, inflation-adjusted wages, and inflation-adjusted retail sales. The indexes are weighted so that movements in the index represent underlying co-movements in the indicators and thus the underlying state of the economy and illustrate each metro’s patterns of recessions and expansions.

Austin’s index has risen every month since October of 2009 and the rate of growth has increased each of the last 12 months. November’s growth is the fastest the index has expanded since August of 2015. According to the discussion of the Business Cycle Index in last month’s Austin Economic Indicators report from the Dallas Fed, "Strong employment gains in the second half of the year and declines in the unemployment rate have propelled growth in the index."

The graph above and the one below show views of the indexes for Texas’ largest metros over longer and shorter range spans. The first indicates the path over the last three-plus decades and the second shows the indexes rebased from 1980 to 2007 to isolate the relative courses of the metros over the last decade.

Following the recession, the five major metros began expanding again between October 2009 and January 2010. Since the end of 2009, Austin’s index has grown 83%, while Dallas, San Antonio, Houston,[1] and Fort Worth have grown 48%, 45%, 35% and 31% respectively.

The pre-recession Business Cycle Index peaks for the metros occurred between May and August of 2008. Austin is 77% ahead of mid-2008. Dallas and San Antonio have advanced by 42% and 39% respectively, while Fort Worth and Houston are up 26%.

The following graph shows the monthly percent change in Austin’s index compared to the state Business Cycle Index.

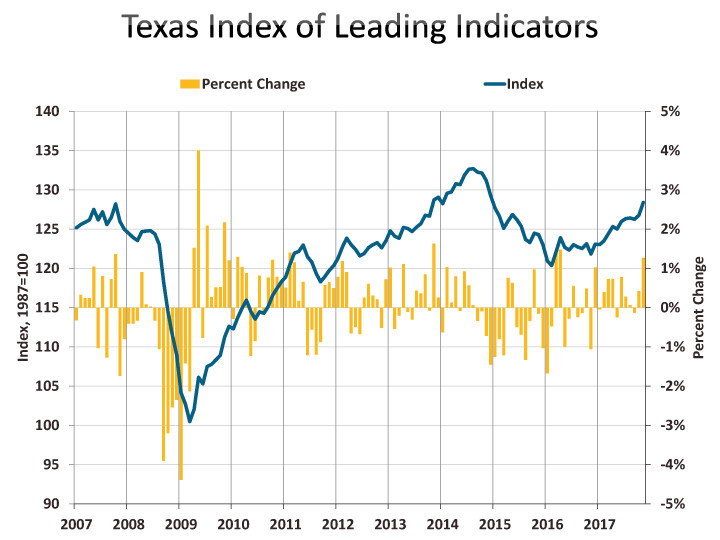

In addition to the Business Cycle Index, which is a coincident index, the Dallas Fed also produces a Texas Leading Index to forecast future economic activity for the state.

This Index is up 1.3% in November and has been positive nine of the last 12 months. The following graph shows the three-month percent change through November in the eight different components of the Leading Index.

The Leading Index is used to generate a state employment forecast and the most recent forecast by the Dallas Fed is for 2.5% job growth statewide in 2017 (December/December). Yesterday's press release from the Dallas Fed, in advance of this month's update to the state employment forecast, reported that statewide job growth is forecast to strengthen to 3.0% in 2018. “The Texas economy is firing on all cylinders going into 2018,” senior economist Keith Phillips said. “If oil prices remain above $40 per barrel, Texas likely will see continued broad-based growth across regions and sectors.”

The Metro Business Cycle Index, as well as the Texas Business Cycle and Leading Indexes are included in the Chamber’s monthly Economic Indicators report and associated Excel files. Note that all of the data displayed and discussed above is seasonally adjusted.

FOOTNOTE:

[1] Houston’s spikiness is primarily due to the oil market, although Hurricane Harvey is tied to movements in 2017. According to the Dallas Fed, “Oil prices are responsible for much of Houston’s volatility. They affect oil producers’ revenues and future drilling activity. The supply chains for most U.S. oil and gas operations have connections to Houston—an industry headquarters city—although little oil is being produced in the immediate area. Houston retains the title ‘energy capital of the world,’ despite diversification and deepening connections to the broader U.S. economy over the past 30 years”