Job growth & unemployment

Sign up for the Central Texas Economy Report newsletter

For opportunities with Austin employers currently hiring, see the Chamber's Austin Job Opportunities page.

Posted on 06/23/2020 by Beverly Kerr

- Austin added 18,300 jobs in May, narrowing pandemic-related job losses to 110,300.

- Austin’s leisure and hospitality industry regained 15,100 jobs in May, but employment stands at 62% of its pre-pandemic level.

- Austin’s 7.7% year-over-year job loss is more moderate than the declines seen in most major metros.

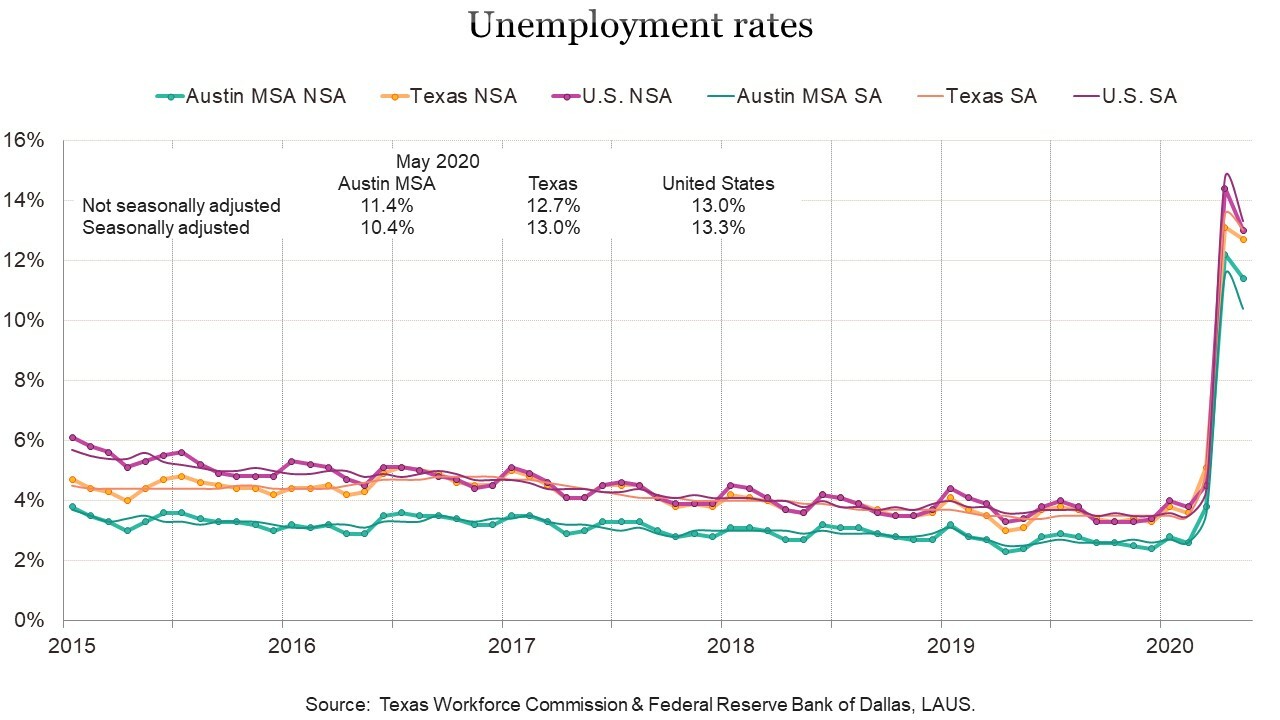

- Austin's seasonally adjusted unemployment rate is 10.4%, down from 11.5% in April. The rate was 2.5% a year ago.

Nonfarm payroll jobs

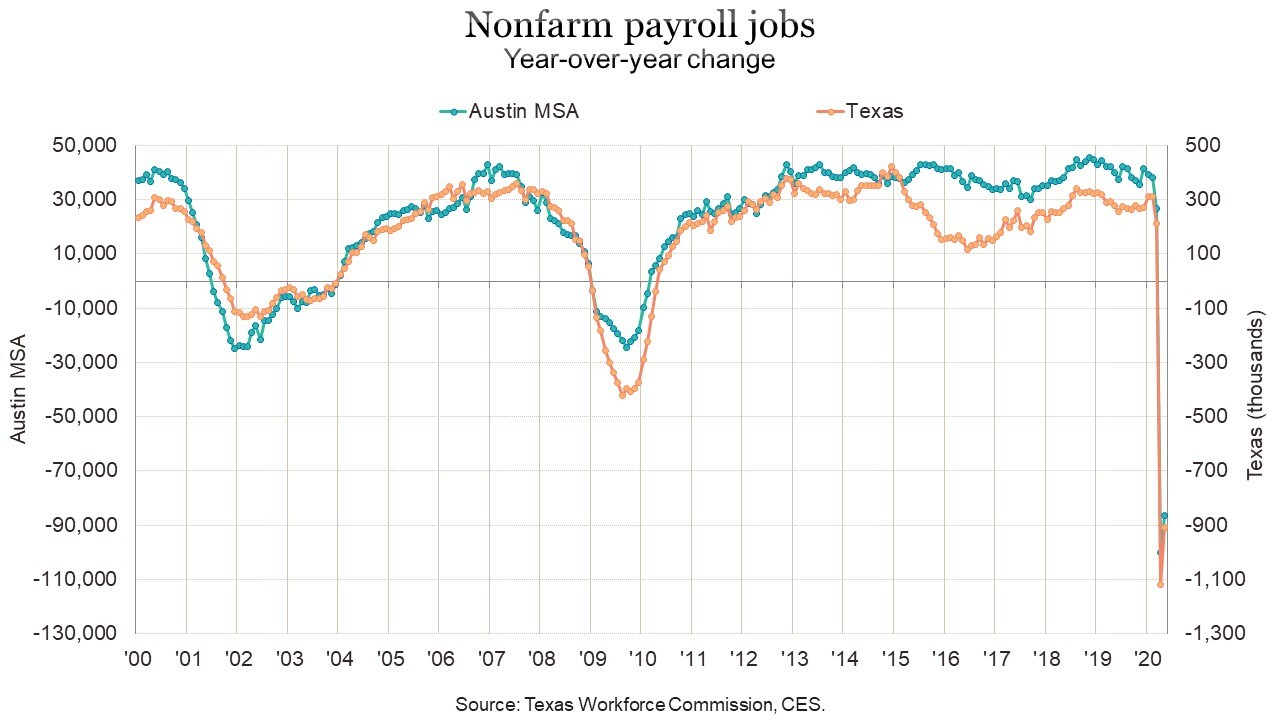

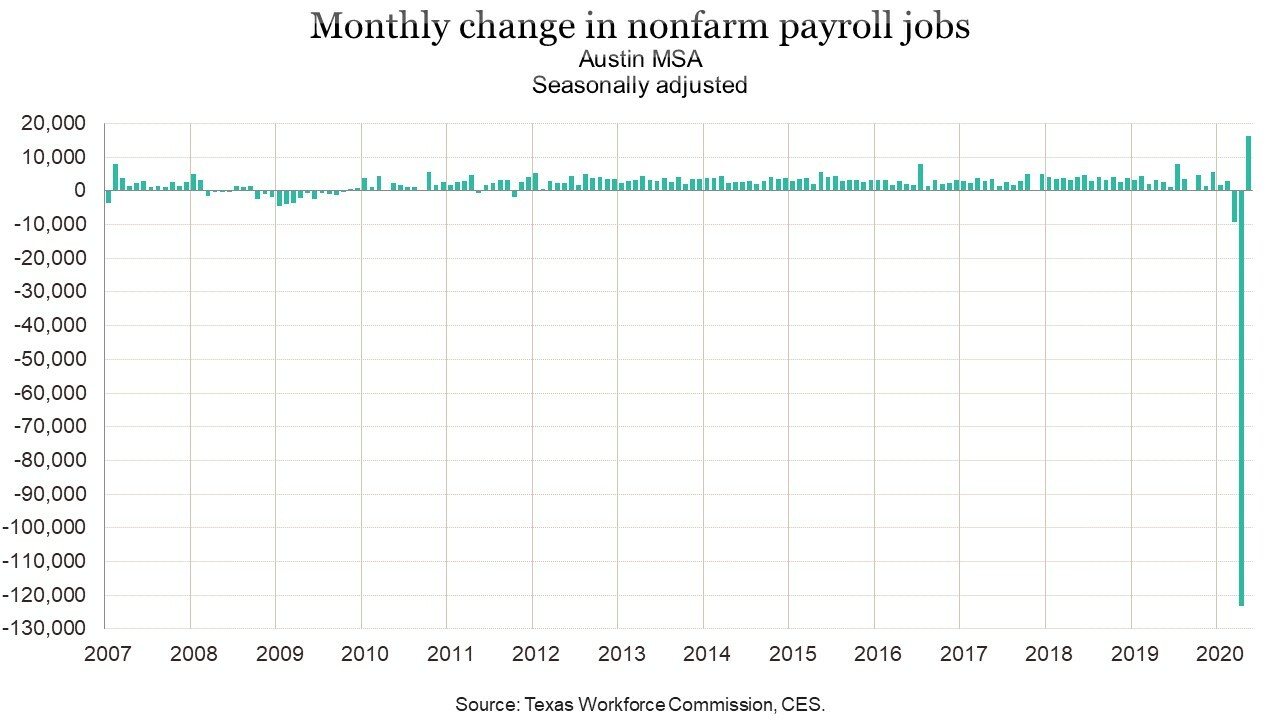

The Austin metropolitan area added 18,300 jobs in May, narrowing pandemic-related job losses to 110,300, according to Friday's releases of preliminary Current Employment Statistics (CES) payroll jobs numbers by the Texas Workforce Commission (TWC) and the U.S. Bureau of Labor Statistics (BLS).

Friday also brought a revision by the Federal Reserve Bank of Dallas to their forecast of Texas’ job change for the calendar year. The Dallas Fed has decreased its projection of job losses for 2020. Last month, the Dallas Fed estimated that Texas’ jobs would decline by 11.7% this year (December 2019 to December 2020). On Friday, the projected decline was revised to 3.2%. Statewide employment in December 2020 is projected to be 12.5 million instead of the previously estimated 11.4 million. If Austin could look forward to a rebound comparable to what the Dallas Fed now projects for the state, then Austin’s December 2020 jobs total might be approximately 1,106,000, and we could look forward to another 78,000 jobs being restored between now and then.

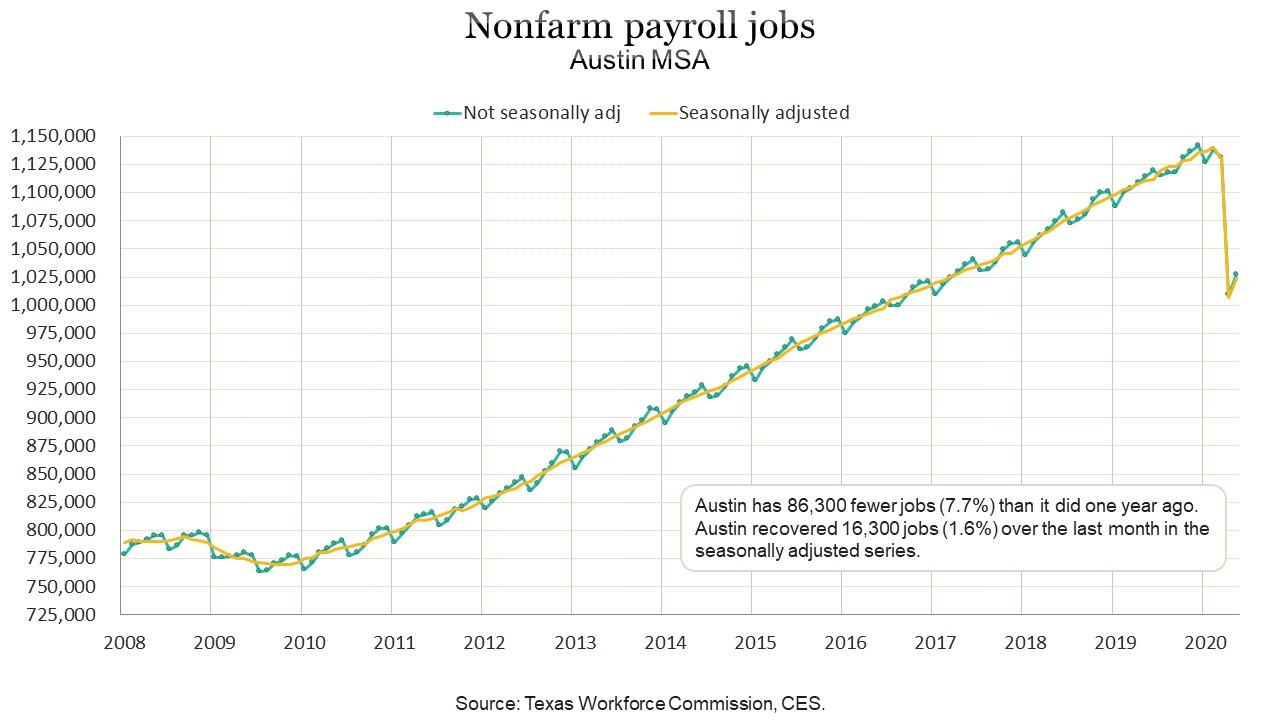

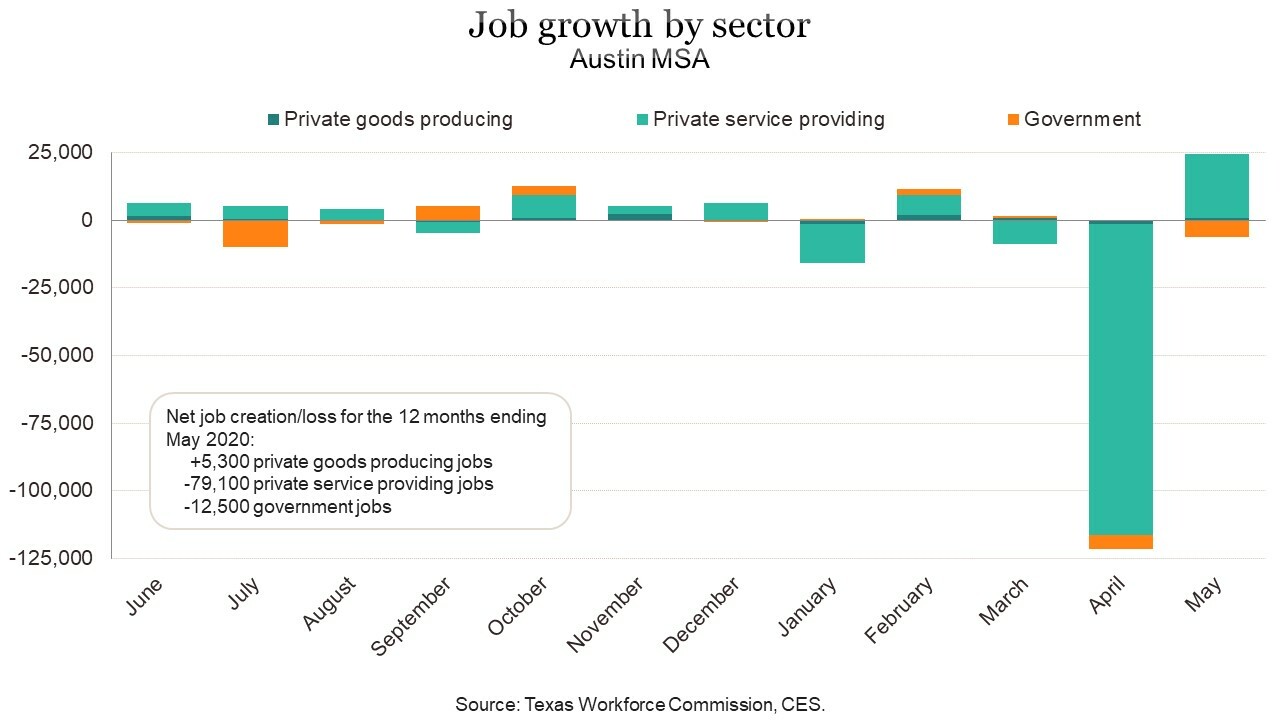

Austin’s nonfarm payroll jobs total as of May is 1,027,600. The last time Austin had approximately the same number of jobs was spring 2017. In February, before the impacts from COVID-19, Austin had an estimated 1,137,900 jobs (38,000 jobs or 3.5% above the same month of 2019—an average trajectory for Austin in recent years). Combining job losses for March and April, Austin lost 128,600 jobs, or 11.3%. May brings back 18,300 of those jobs.

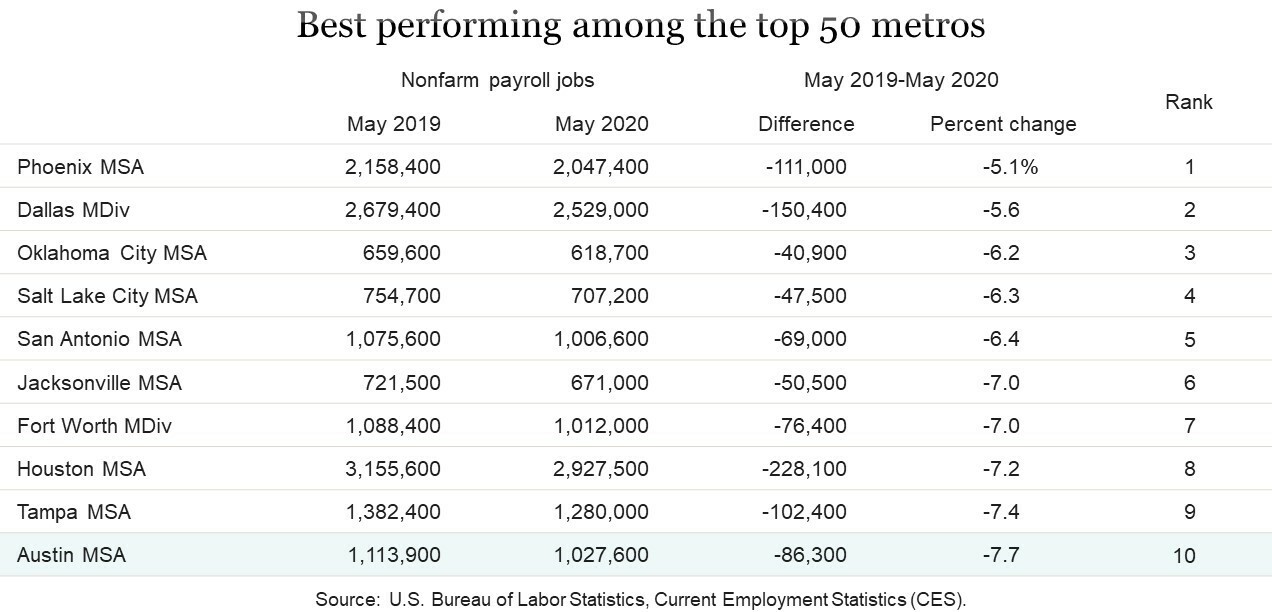

As dismal as these losses are, Austin’s year-over-year decline of 7.7%, or 86,300 jobs, makes it the tenth “best performing” among the 50 largest metro areas. Each of the other major Texas metros also ranked in the top 10. The deepest losses among major metros were in Las Vegas (21.3%) and Detroit (20.7%).

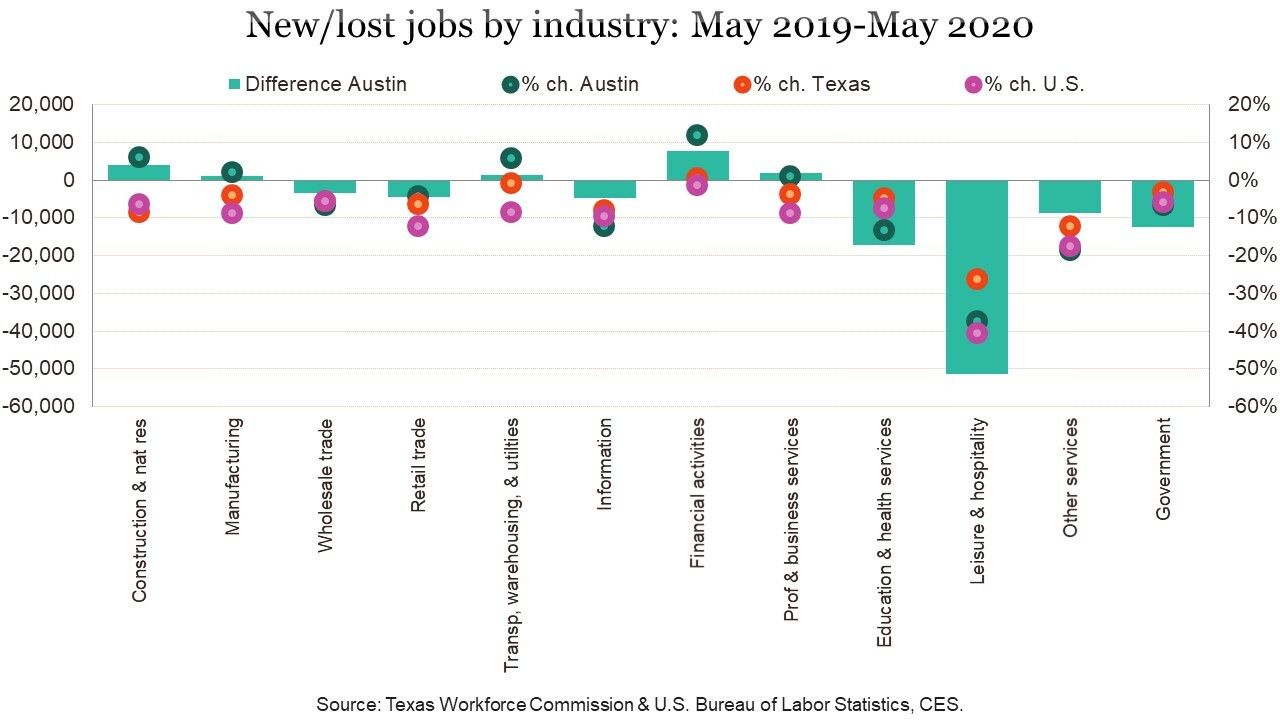

For the year ending in May, private sector job loss in the Austin MSA is 8.0%, or 73,800 jobs, with losses occurring in six of the 11 major private industry sectors. Austin's sizable government sector (17% of jobs) shrank by a relatively moderate 12,500 jobs or 6.6%, thus bringing the overall growth rate to 7.7%.

Texas saw net private sector job losses of 7.8% with all private industries, but one, losing jobs over the last 12 months. Total job losses were only 7.1% as the government sector, which accounts for 15% of total state employment, had slighter losses (3.2%). For the nation, private sector losses were 12.8% for the 12 months ending in May with all private industries, losing jobs. Overall job growth was 11.8% as government sector’s losses were relatively moderate (6.0%).

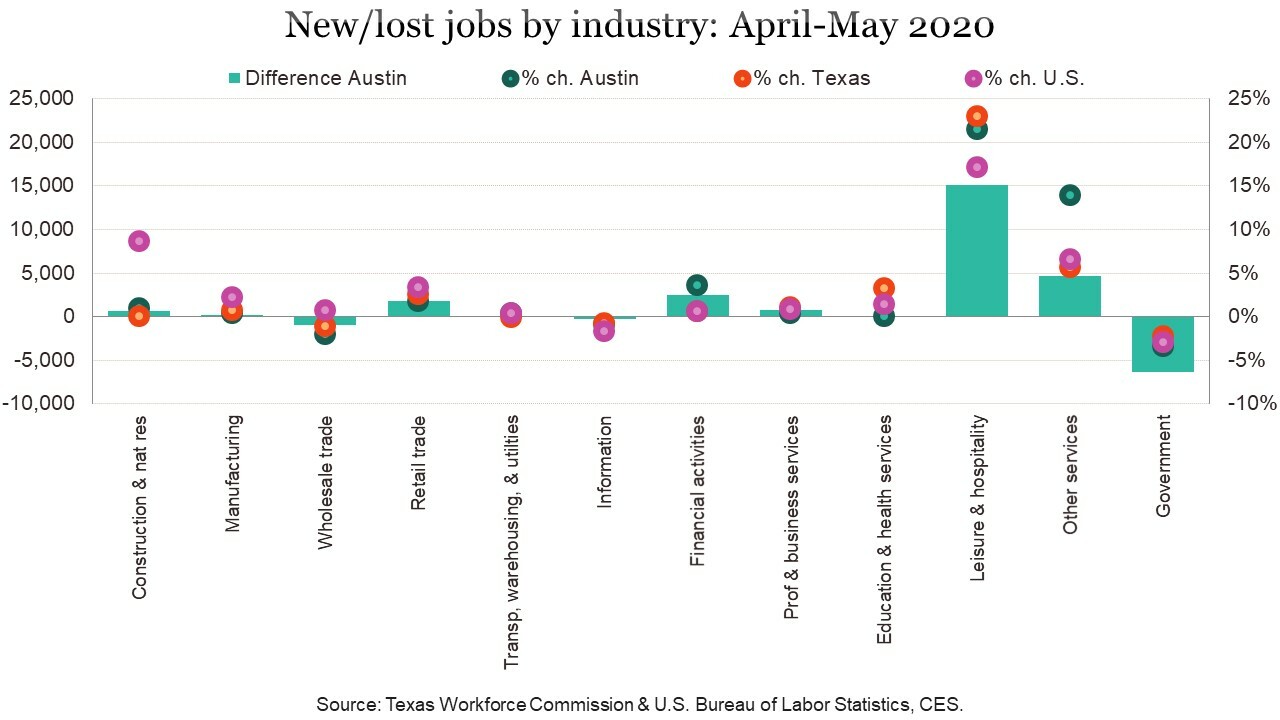

Jobs in May are up by 18,300 jobs or 1.8% from April in the not-seasonally-adjusted series for Austin. In the seasonally adjusted series, jobs increased by 16,300 or 1.6%. Seasonally adjusted jobs are up by 2.9% in San Antonio and Fort Worth, 2.2% in Houston, and 1.9% in Dallas. Statewide, seasonally adjusted jobs are up 237,800 or 2.0%. Nationally, seasonally adjusted jobs are up from April by 2.5 million or 1.9%.

In Austin, five private industry sectors have positive growth over the last 12 months, most notably financial activities (7,800 jobs or 11.9%), construction and natural resources (4,100 or 6.0%); transportation, warehousing and utilities (1,300 or 5.8%). Manufacturing and professional and business services also added jobs.

The greatest number of job losses, and greatest percent change, over the last year happened in leisure and hospitality (51,300 or 37.6%). There were also double-digit losses in other services (8,800 jobs or 18.6%), education and health services (17,200 or 13.4%), and information (4,800 or 12.4%). Wholesale trade and retail trade saw more moderate contractions.

Compared to our last pre-pandemic month, February, all industries have lost jobs except financial activities and construction and natural resources. The most notable losses over the last three months are in leisure and hospitality (52,200 jobs or 38.1%), other services (21.6%), education and health services (15.5%), and information (13.3%). Leisure and hospitality added back 15,100 jobs in May, reducing what had been losses of 67,300 jobs (48.9%) in March and April. As of May, employment stands at 85,300. The last time Austin’s leisure and hospitality industry had a similar level of employment was 2010.

Statewide, over the last 12 months, only financial activities added jobs, 3,000 (0.4%). Double-digit losses were seen in leisure and hospitality (26.4% or 372,200 jobs) and other services (12.4% or 55,500).

Nationally, no industries added jobs and three industries lost job at double-digit rates over the 12 months ending in May: leisure and hospitality (40.6% or 6.8 million), other services (17.6% or 1.0 million), and retail trade (12.2% or 1.9 million).

Over the last 12 months, the net loss for private service-providing industries in Austin is 79,100 jobs, or 10.0%. Employment in goods producing industries is up by 5,300 jobs or 4.1%. Statewide, private service-providing industries are down 720,400, or 8.1%, and goods producing industries are down 125,200 jobs, or 6.5%.

Between April and May, Austin’s goods producing industries added 900 jobs or 0.7%, while private service providing industries added 23,700 jobs or 3.4%. Statewide, jobs increased by 6,400 or 0.4% in goods producing industries and by 310,100 or 4.0% in private service providing industries.

Labor force, employment & unemployment

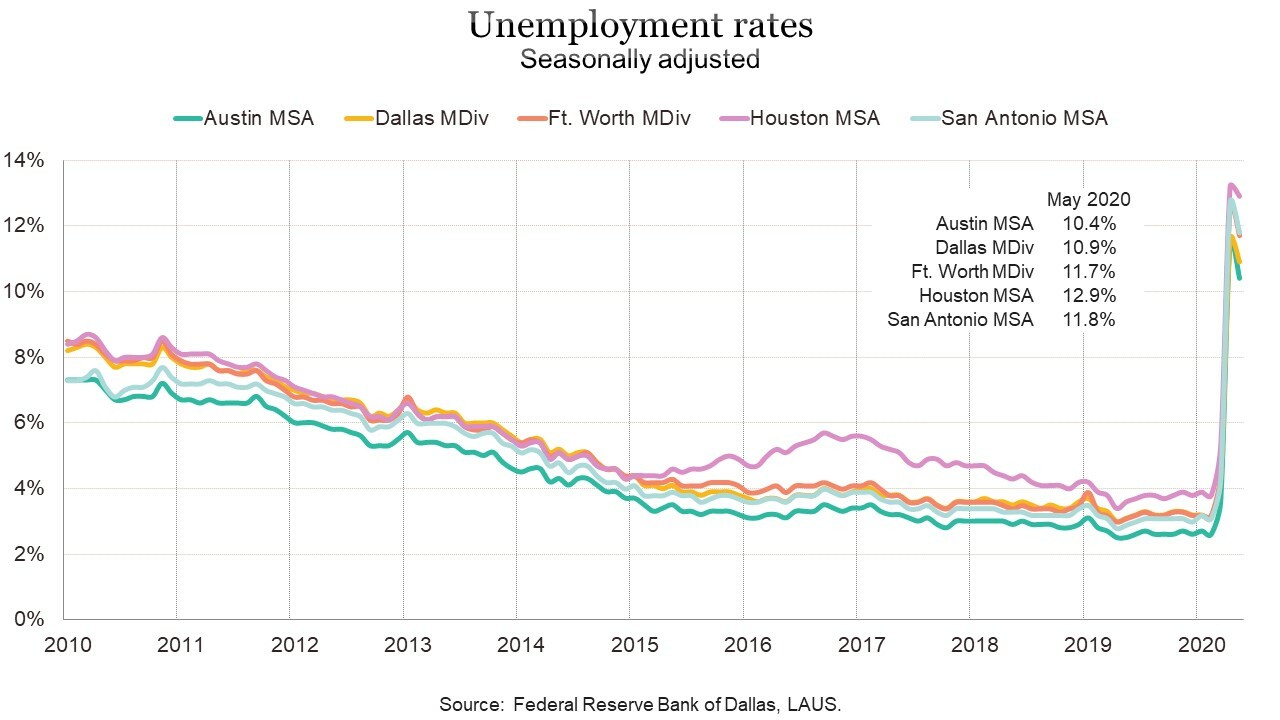

We also now have May labor force, employment, and unemployment numbers for Texas and local areas in Texas. The same data for all U.S. metros will not be released until July 1. In April, Austin had the 15th lowest rate of unemployment among the 50 largest metros. New unemployment numbers show Austin’s performance relative to the state and other major Texas metros being sustained.

In May, Austin is at 11.4%, while the other major metros range from 12.1% in Dallas to 13.9% in Houston. Fort Worth is at 12.6% and San Antonio is at 12.7%. Austin’s rate one year ago was 2.4%. The rates in the other major Texas metros are elevated from a year ago by from 9.1 to 10.5 percentage points. The statewide not-seasonally-adjusted rate is now 12.7%, up from 3.1% in May of last year. The national unemployment rate is 13.0%, up from 3.4% a year ago.

Within the Austin MSA, Bastrop County has the lowest unemployment rate at 10.3% in May while Hays County has the highest at 11.7%. The rate is 11.6% in Travis County, 10.8% in Williamson County, and 10.4% in Caldwell County.

On a seasonally adjusted basis, Austin’s May unemployment rate is 10.4%, down from 11.5% in April. The statewide rate is 13.0%, down from 13.5%, and the national rate is 13.3%, down from 14.7% in April.

In the aftermath of the dot-com bust, the highest seasonally adjusted unemployment rate reached in Austin was 6.1%. In the Great Recession, the highest rate was 7.5% and rates over 7% prevailed for 12 months.

Among Texas’ other major metros, Dallas has the next lowest seasonally adjusted unemployment rate, at 10.9%, in May, while Fort Worth is 11.7%, San Antonio is at 11.8%, and Houston’s rate is 12.9%. Seasonally adjusted unemployment rates for Texas metros are produced by the Federal Reserve Bank of Dallas. (The TWC also produces seasonally adjusted rates for Texas metros, but publication lags the Dallas Fed’s data.)

In February, before pandemic impacts, the number unemployed in Austin was 33,432 (very close to 2019’s annual average). The number climbed to 47,371 in March and 138,785 in April. In May, the estimate of unemployed improves to 132,803, which is 359% above the level of one year ago.

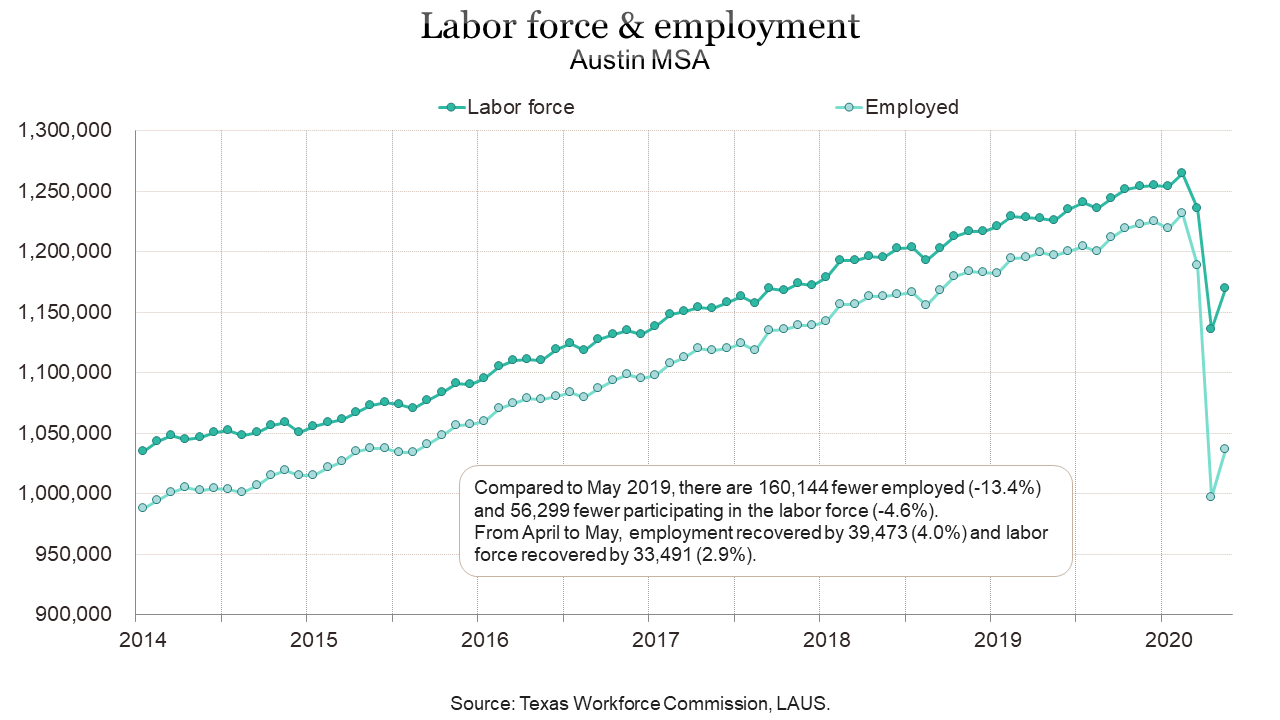

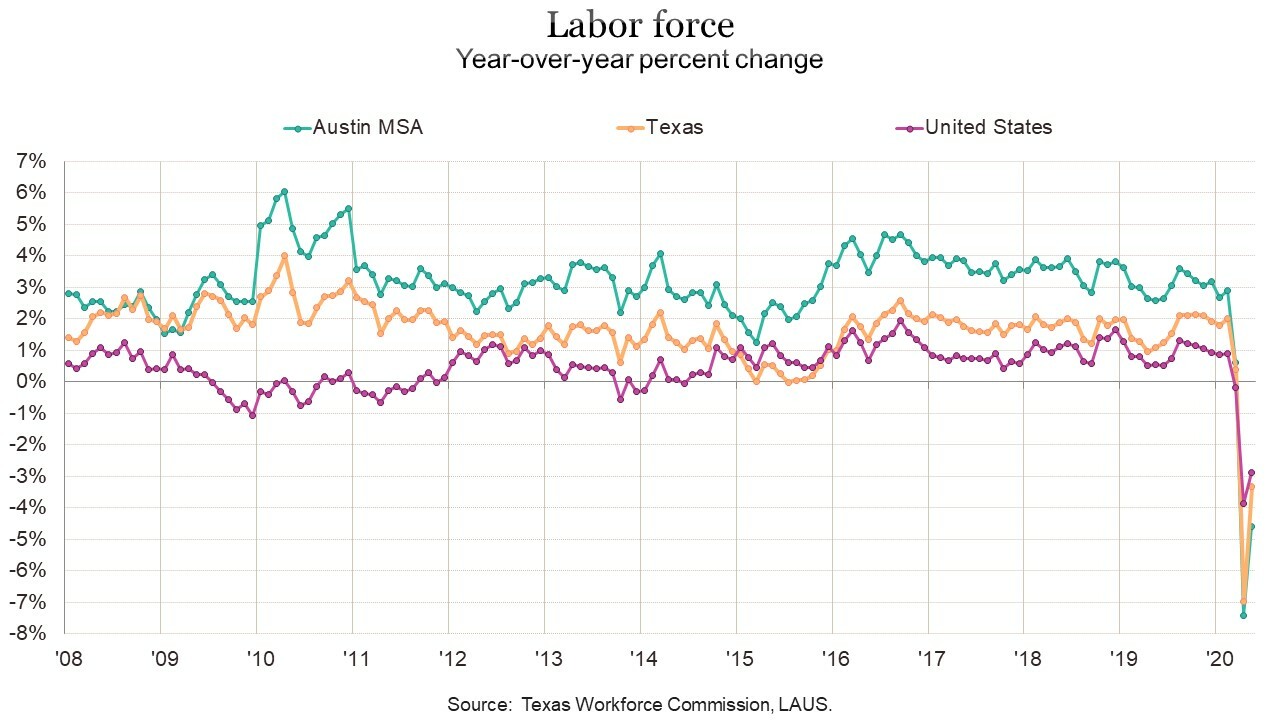

The Austin metro’s civilian labor force (employed plus unemployed) fell by 128,719 persons or 10.2% from February to April, while persons employed decreased by 234,072 or 19.0%. Both labor force and employed regained some losses in May so that May’s labor force stands at 7.5% below what it was in February and employed is estimated at 15.8% below. Compared to one year ago, labor force is 4.6% lower and employed is 13.4% lower.

Labor force and employment also grew in May for Texas and the nation following March and April losses.

Texas’ employment is 1,739,006 million or 12.9% below last May, while labor force is lower by 463,975 million or 3.3%. Thus, the number of unemployed increased by 1,275,031 million or 293%. Nationally, May civilian labor force is down by 4.7 million or 2.9% year-over-year, while employed is below the level seen in May 2019 by 19.7 million or 12.5%, and 15.0 million more people (273%) are unemployed.

The TWC and the BLS will release June estimates on July 17.

The Chamber’s Economic Indicators page provides up-to-date historical spreadsheet versions of Austin, Texas and U.S. data for both the Current Employment Statistics (CES) and Local Area Unemployment Statistics (LAUS) data addressed above.