Job Growth & Unemployment

Posted on 11/22/2016 by Beverly Kerr

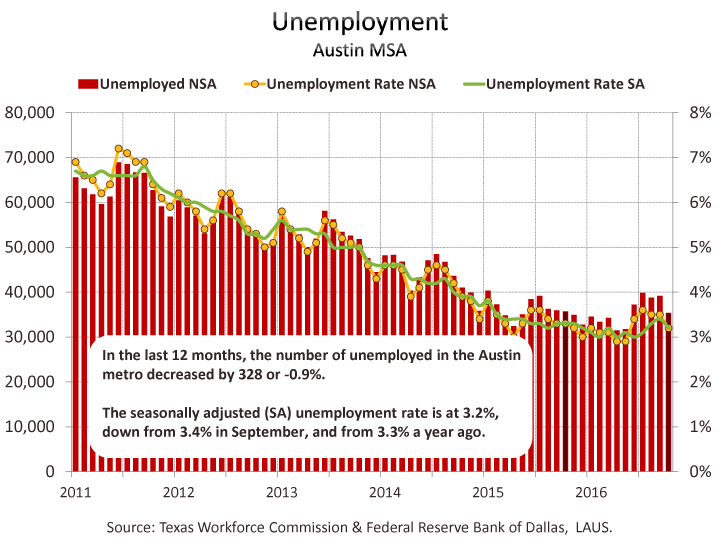

- Austin's seasonally adjusted unemployment rate is 3.2%, down from 3.4% in September.

- In the 12 months ending in October, Austin added 21,200 net new jobs, growth of 2.2%. For this period, Austin is the 20th fastest growing major metro.

- Education and health services added the most jobs (3,800 or 3.4%) in the past year, however, the fastest growing industries are financial activities (5.7%) and wholesale trade (5.6%).

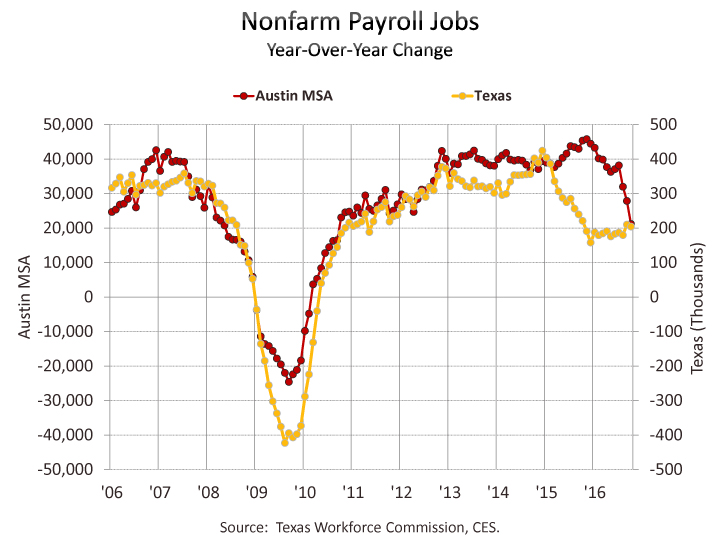

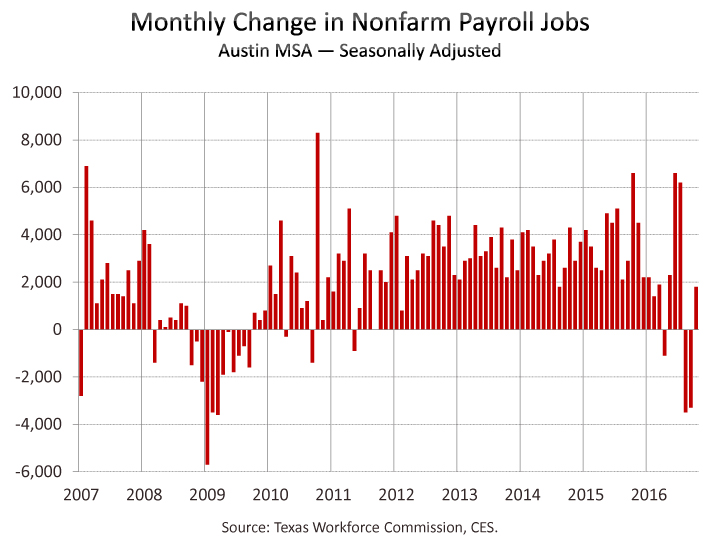

The Austin metropolitan area added 21,200 net new jobs, or 2.2%, in the 12 months ending in October, according to Friday's release of preliminary payroll jobs numbers by the Texas Workforce Commission (TWC) and the U.S. Bureau of Labor Statistics (BLS). October appears to continue (numbers are preliminary) a drop off in Austin’s rate of job growth that began in August. The first seven months of 2016 averaged better than 4% year-over-year growth, but in August the rate fell to 3.3%, followed by 2.9% in September.

Austin’s 2.2% growth makes it the 20th best performing among the 50 largest metro areas. Orlando topped the ranking by growing at 4.0%, while Seattle was second with growth of 3.9%. Dallas, at 3.8%, was the third fastest growing job market and the only Texas metro in the top ten. Fort Worth grew by 2.1% (24th), San Antonio grew by 1.3% (40th), and Houston grew by 0.4% (48th) between October 2015 and October 2016.

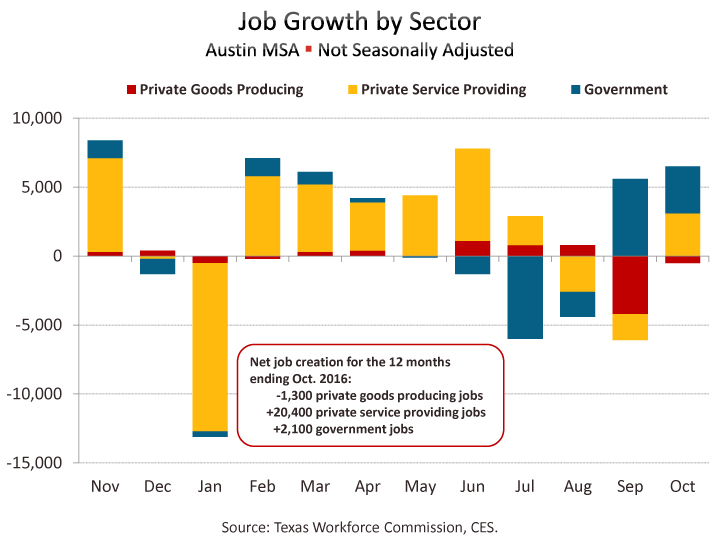

For the year ending in October, private sector job growth in the Austin MSA is 2.4%, or 19,100 jobs, and with all private industry divisions, except manufacturing, contributing to the growth. Austin's sizable government sector (nearly 18% of jobs) saw modest growth over the last 12 months, gaining 2,100 jobs or 1.2%, thus bringing the overall job growth rate to 2.2%.

Texas saw weaker net private sector job growth of 1.6% with nine of eleven private industry divisions adding jobs over the last 12 months. The government sector, which accounts for over 16% of total state employment, grew faster, 2.5%. Overall job growth was 1.7%. For the nation, private sector growth is 1.7% for the 12 months ending in October, with all private industries, but manufacturing, adding jobs. Overall job growth is a more modest 1.6% because the government sector gained only 0.9%.

Jobs in October are up from September by 6,000 jobs or 0.6% in the not-seasonally-adjusted series for Austin. Job change from September to October is up in the seasonally adjusted series by 1,800 or 0.2%. Houston’s seasonally adjusted growth was also 0.2%. Dallas gained 0.1%, Fort Worth was essentially unchanged, and seasonally adjusted jobs fell by 0.3% in San Antonio from September to October. Statewide, seasonally adjusted jobs are up 13,700 or 0.1% in October. Nationally, seasonally adjusted jobs are also up 0.1%.

In Austin, the industry adding the most jobs over the last 12 months is education and health services which grew by 3,800 jobs, or 3.4%. Financial activities grew fastest at 5.7% (3,100 jobs), followed by wholesale trade at 5.6% (2,800 jobs) and construction and natural resources at 5.2% (3,000). Also growing at a faster-than-average rates are other services at 3.6% (1,500), transportation, warehousing and utilities at 3.1% (500), and information at 3.0% (800). Manufacturing lost 7.5% or 4,300 jobs. [For a graphical look at the last decade of some of these industries' growth in Austin compared to the state and the nation, click on the embedded links in this paragraph.]

Statewide, education and health services grew fastest, 3.9%, and added the most jobs (63,300). The other relatively fast growing private industries include financial activities and leisure and hospitality (both at 3.1%), wholesale trade (2.3%), other services (2.1%), and retail trade (2.0%). Construction and natural resources lost 29,600 jobs, or 3.1%, and manufacturing jobs declined by 19,800, or 2.3%, and over the last 12 months.

Nationally, professional and business services grew fastest, adding 2.7% over the 12 months ending in October. The other industries growing at faster-than-average rates were education and health services (2.6%), financial activities (2.1%), and leisure and hospitality (1.9%). The number of manufacturing jobs declined by 0.5%.

The net gain for private service-providing industries in Austin is 20,400 jobs, or 3.0%, over the last 12 months. Employment in goods producing industries is down by 1,300 jobs or 1.1%. Statewide, private service-providing industries are up 207,500 or 2.5%, while goods producing industries are down 49,400 jobs or 2.7%.

We also now have October labor force, employment, and unemployment numbers for Texas and local areas in Texas. The same data for all U.S. metros that we often do a ranking of will not be released until November 30. In September, Austin had the sixth lowest rate of unemployment among the 50 largest metros.

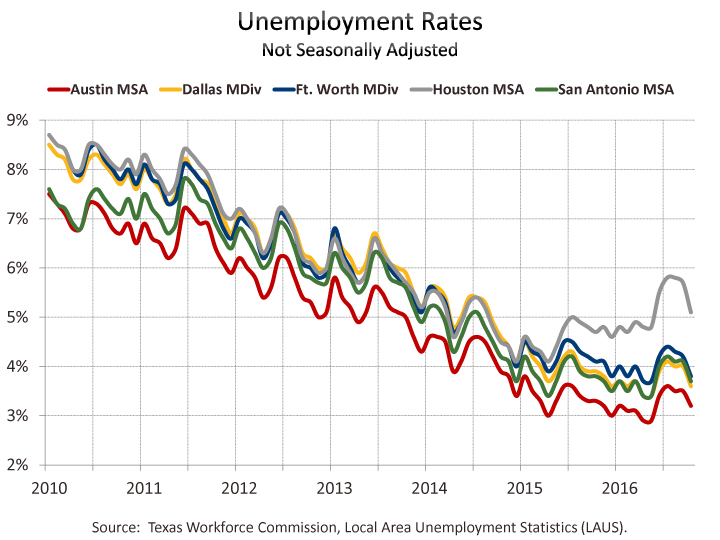

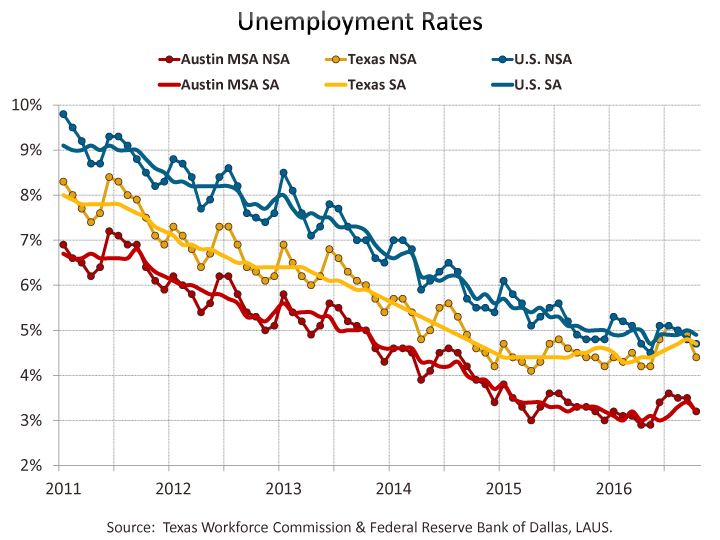

Unemployment numbers for October show Austin’s performance relative to the state and other major Texas metros being sustained. In October, Austin is at 3.2%, while the other major metros range from 3.6% in Dallas to 5.1% in Houston. San Antonio is at 3.7% and Fort Worth is at 3.8%. Austin’s rate was 3.3% a year ago. Rates in Dallas, Fort Worth and San Antonio are also improved over October of last year. Houston’s rate was lower (4.7%) a year ago.

In July and August, Texas and the nation shared the same not-seasonally-adjusted unemployment rates, 5.1% in July and 5.0% in August. In September, Texas had a higher unemployment rate, 4.9%, than the national rate (4.8%). The last time Texas’ unemployment rate exceeded the national rate was in November 2006. In October, Texas’ rate fell to 4.4%, restoring the state back to a level below the national rate of 4.7%.

In 2007, before the impact of the Great Recession, unemployment averaged 3.6% in Austin, 4.3% in Texas, and 4.6% nationally. Unemployment has been at or below pre-recession levels for 21 months in Austin. Texas’ year-to-date average (4.6%) is above what it averaged in 2007. The nation, with unemployment averaging 4.9% in 2016, has also not regained its pre-recession level of unemployment.

Within the Austin MSA, Travis County has the lowest unemployment rate in October, at 3.1%, while Caldwell County has the highest at 4.0%. The rate is 3.3% in Hays and Williamson Counties and 3.6% in Bastrop County.

On a seasonally adjusted basis, Austin’s October unemployment rate is 3.2%, down from 3.4% in September. The statewide rate is 4.7%, down from 4.8% in September. Nationally, the seasonally adjusted unemployment rate is 4.9%, down from 5.0% in September.

Among Texas’ major metros, Fort Worth shares Austin’s 3.2% seasonally adjusted rate, while San Antonio, Dallas, and Houston are at 3.6%, 4.2%, and 4.6% respectively. As with Austin, October rates are down from September in each of the other metros. Seasonally adjusted unemployment rates for Texas metros are produced by the Federal Reserve Bank of Dallas. (The TWC also produces seasonally adjusted rates for Texas metros, but publication lags the Dallas Fed’s data.)

With Austin’s unemployment rate down from the rate one year ago, the number of unemployed is down by 328 or 0.9%. In October 2016, Austin’s number of unemployed is 35,325. The number of unemployed in Austin averaged more than 60,000 for three years running during the Great Recession.

The Austin metro’s civilian labor force (employed plus unemployed) has increased by 2.3% or 24,669 persons from one year ago, while persons employed increased by 2.4% or 24,997. Texas saw 1.7% growth in both labor force and in employed, while the number unemployed increased by 0.4% or 2,222. Nationally, October civilian labor force is up by 1.6%, while employed is above the level of a year ago by 1.7%, and 150,000 fewer people (2.0%) are unemployed.

The Texas Workforce Commission will release November estimates on December 16.

The Chamber’s Economic Indicators page provides up-to-date historical spreadsheet versions of Austin, Texas and U.S. data for both the Current Employment Statistics (CES) and Local Area Unemployment Statistics (LAUS) data addressed above.

Related Categories: Central Texas Economy in Perspective