Job Growth & Unemployment

Posted on 11/21/2017 by Beverly Kerr

- Austin added 22,200 net new jobs, growth of 2.2%, in the 12 months ending in October, making Austin the 17th fastest growing major metro.

- Wholesale trade was the fastest growing industry in the Austin MSA, increasing jobs by 7.1% (3,500 jobs) over the last 12 months. Leisure and hospitality added the most jobs—6,000 (4.9% growth).

- Manufacturing jobs grew 5.1% year-over-year, outpacing private industry growth for the seventh month in a row.

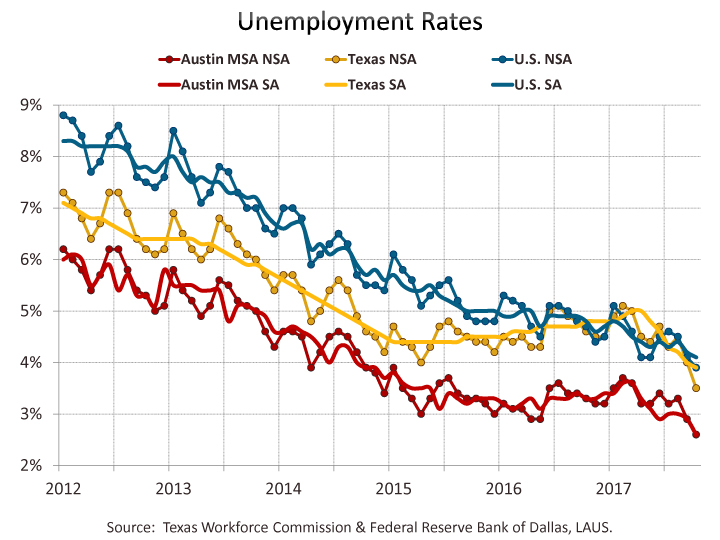

- Austin's seasonally adjusted unemployment rate is 2.6%, reduced from 2.9% in September. Texas’ rate fell below 4.0% for the first time since the published data begins in 1976.

The Austin metropolitan area added 22,200 net new jobs, or 2.2%, in the 12 months ending in October, according to Friday's releases of preliminary payroll jobs numbers by the Texas Workforce Commission (TWC) and the U.S. Bureau of Labor Statistics (BLS).

Austin’s 2.2% growth makes it the 17th best performing among the 50 largest metro areas. San Antonio (up 2.9%), Dallas (up 2.7%), and Fort Worth (up 2.6%) ranked fourth, seventh, and ninth respectively. Houston’s 1.6% gain ranked 25th.

For the year ending in October, private sector job growth in the Austin MSA is 2.3%, or 19,200 jobs, with all but three private industry divisions adding jobs. Austin's sizable government sector (nearly 18% of jobs) saw more moderate growth over the last 12 months, gaining 3,000 jobs or 1.7%, thus bringing the overall job growth rate to 2.2%.

Texas saw net private sector job growth of 2.7% with all private industries, except one, adding jobs over the last 12 months. Total job growth was 2.6% as the government sector, which accounts for over 16% of total state employment, gained only 1.9%. For the nation, private sector growth is 1.6% for the 12 months ending in October with all private industries, but two, adding jobs. Overall job growth is a more modest 1.4% because government sector growth was only 0.3%.

Jobs in October are up from the preceding month by 9,100 jobs or 0.9% in the not-seasonally-adjusted series for Austin. In the seasonally adjusted series, growth from September to October is 3,000 jobs or 0.3%. Seasonally adjusted jobs are up by 0.9% in Houston, 0.3% in San Antonio, and 0.2% in Dallas and Fort Worth. Statewide, seasonally adjusted jobs are up in October by 71,500 jobs or 0.6%. Nationally, seasonally adjusted jobs are up 0.2% from September.

In Austin, the industry adding the most jobs is leisure and hospitality which grew by 6,000 jobs, or 4.9%, over the last 12 months. Wholesale trade grew fastest at 7.1% and added 3,500 jobs. Also growing at faster-than-average rates are manufacturing (5.1% or 2,800 jobs); construction and natural resources (4.7% or 2,800 jobs); transportation, warehousing and utilities (4.4% or 800 jobs); and education and health services (4.2% or 5,000 jobs). For the seventh month in a row, manufacturing job growth outpaces private job growth. The last time manufacturing grew at a greater rate than the growth rate for all private industries was a three month period during 2011. The only other occasions when manufacturing posted faster-than-average growth rates were before the dot com recession of the early 2000s.

Two of Austin’s industries have fewer jobs than one year ago: information (-1,200 or -4.2%) and retail trade (-1,500 or -1.4%). Professional and business services jobs are unchanged from one year ago. Growth in professional and business services and retail trade have undergone a steady deceleration since around the beginning of 2016. Leisure and hospitality is growing at a fairly robust pace, but lower than the 7.0% rate averaged during 2013-15. Among Austin’s four large private sector industries, only education and health services is holding on to the pace of the last several years. Click here for graphs of the 2012-2017 growth rate trends for the four largest private industries as well as the seven smaller industries.

Statewide, construction and natural resources grew fastest (5.8%) and added the most jobs (53,500) over the last 12 months. The other relatively fast growing industries included other services (4.5%), manufacturing (4.3%), financial activities (3.7%), and leisure and hospitality (3.1%). Jobs declined in information by 5.4%.

Nationally, construction and natural resources grew fastest, adding 3.1% over the 12 months ending in October. Professional and business services (2.6%), education and health services (2.0%), and transportation, warehousing and utilities (1.9%), and leisure and hospitality (1.8%) were also relatively fast growing. Information jobs fell by 2.1% and retail trade jobs are down 0.4%.

The net gain for private service-providing industries in Austin is 13,600 jobs, or 1.9%, over the last 12 months. Employment in goods producing industries is up by 5,600 jobs or 4.8%. Statewide, private service-providing industries are up 189,900, or 2.3%, and goods producing industries are up 89,400 jobs, or 5.0%.

Along with Friday’s release of the monthly nonfarm payroll jobs numbers from the Current Employment Statistics (CES) survey discussed above, came a new quarter of jobs numbers from an alternative program called the Quarterly Census of Employment and Wages (QCEW). While there are differences between the universes of jobs represented in the two programs, QCEW is the primary input to the annual benchmark revision process for the CES sample survey-based estimates. QCEW lags several months behind CES, but with two quarters of 2017 now available, this is an occasion to consider whether or not the slowing growth CES indicates is mirrored in QCEW. The first half of 2017 was up 3.5% over the first half of 2016 in the QCEW series (ranging narrowly around that average), but up 3.0% according to CES (ranging from a high of 3.5% in January to a low of 2.7% in June). Click here for graphs comparing CES and QCEW growth for 2012-2017.

The Federal Reserve Bank of Dallas' seasonally adjusted nonfarm payroll jobs estimates incorporate “accelerated benchmarking”—that is, they revise, based on QCEW, jobs estimates quarterly rather than annually. At this time their series is still benchmarked through the first quarter. Presumably next month’s release will be benchmarked through the second quarter and may provide an indication whether or not CES is possibly overstating Austin’s growth slowdown.

Nevertheless, for those four large private sector industries discussed above, QCEW is showing similar trends. Education and health services is growing on par with the trend of 2013-2015. For the three other industries, however, 2016 growth was significantly below 2013-2015, and 2017 is significantly below 2016.[1]

We also now have October labor force, employment, and unemployment numbers for Texas and local areas in Texas. The same data for all U.S. metros will not be released until November 30. In September, Austin had the sixth lowest rate of unemployment among the 50 largest metros.

Unemployment numbers for October show Austin’s performance relative to the state and other major Texas metros being sustained. In October, Austin is at 2.6%, while the other major metros range from 2.9% in San Antonio to 4.1% in Houston. Dallas and Fort Worth are at 3.0%. Austin’s rate one year ago was 3.3%. The rates in Texas’ other major metros are also each below the rates seen a year ago. The statewide not-seasonally-adjusted rate is now 3.5%, down from 4.6% in October of last year. The national unemployment rate is 3.9%, improved from 4.7% in October 2016.

Within the Austin MSA, Travis County has the lowest unemployment rate in October, at 2.5%, while Caldwell County has the highest at 3.1%. The rate is 2.7% in Hays and Williamson Counties and 2.9% in Bastrop County.

On a seasonally adjusted basis, Austin’s October unemployment rate is 2.6%, reduced from 2.9% in September. The statewide rate is 3.9% improved from 4.0% in September. Nationally, the seasonally adjusted unemployment rate is 4.1% in October, down from 4.2% in September. The last time Austin’s unemployment rate was as low as 2.6% was in December of 2000. The national rate is also at its lowest level since December of 2000. The TWC’s (and BLS’s) published time series for Texas’ unemployment rate begins in 1976 and this month is the only occasion that the rate has fallen below 4.0%.

Among Texas’ major metros, Dallas has the next lowest seasonally adjusted rate at 3.2%, while San Antonio, Fort Worth, and Houston are at 3.6%, 3.8%, and 4.5% respectively. October rates are improved from September in each metro. Seasonally adjusted unemployment rates for Texas metros are produced by the Federal Reserve Bank of Dallas. (The TWC also produces seasonally adjusted rates for Texas metros, but publication lags the Dallas Fed’s data.)

With the decrease in Austin’s unemployment rate from one year ago, the number unemployed has also declined. In October 2016, Austin’s number of unemployed was 37,322. Over the last 12 months, the unemployed have decreased by 8,058, or 21.6%, to 29,264.

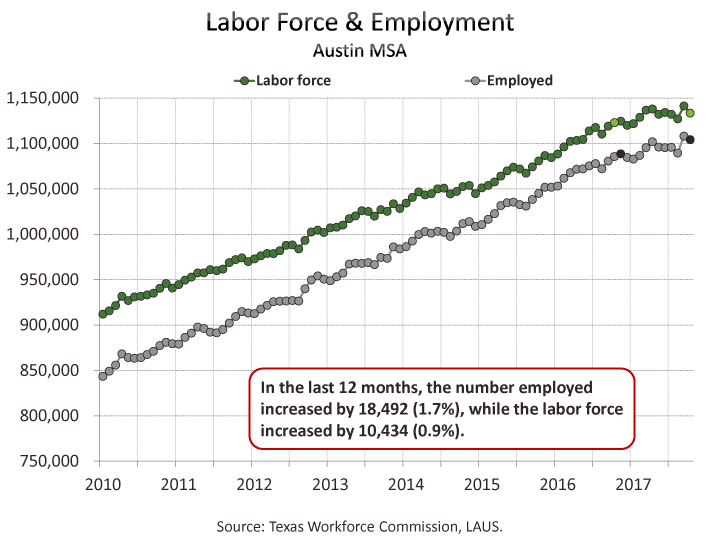

The Austin metro’s civilian labor force (employed plus unemployed) has increased by 0.9% or 10,434 persons from one year ago, while persons employed increased by 1.7% or 18,492. Texas has also seen greater growth in employed (1.5%) than labor force (0.4%), and the number unemployed decreased by 142,665 or 23.3%. Nationally, October civilian labor force is up by 0.4%, while employed is above the level of a year ago by 1.2%, and over 1.2 million fewer people (16.2%) are unemployed. Click here for graphs of the 2012-2017 growth rate trends for labor force and employment.

The Texas Workforce Commission November estimates on December 22.

FOOTNOTE:

[1] According to QCEW, Austin’s professional and business services industry averaged year-over-year growth of 7.4% over 2013-2015, 4.2% growth in 2016, and 2.7% in the first half of 2017. Leisure and hospitality averaged year-over-year growth of 7.0% over 2013-2015, 5.7% growth in 2016, and 3.0% in the first half of 2017. Retail trade averaged year-over-year growth of 4.0% over 2013-2015, 3.1% growth in 2016, and 2.3% in the first half of 2017.

Related Categories: Central Texas Economy in Perspective