Job Growth & Unemployment

Posted on 09/25/2018 by Beverly Kerr

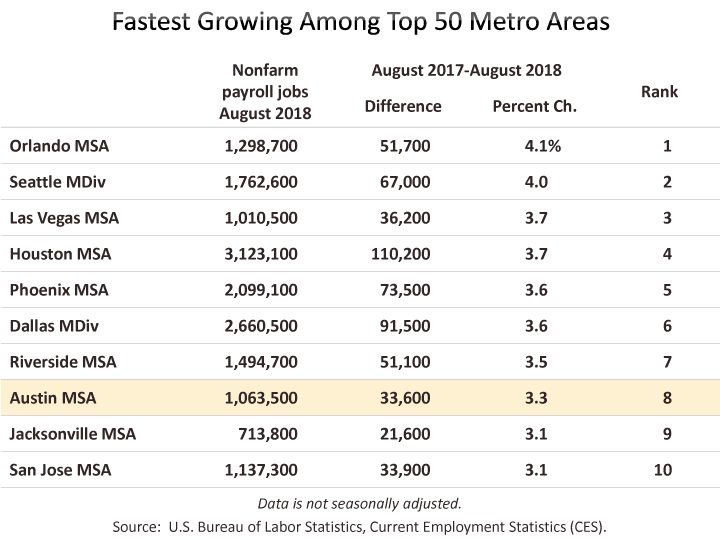

- Austin added 33,600 net new jobs, growth of 3.3%, in the 12 months ending in August, making Austin the 8th fastest growing major metro.

- Wholesale trade was the fastest growing industry in the Austin MSA, increasing jobs by 13.3% (6,900 jobs) over the last 12 months. Professional and business services added the most jobs—9,900 (5.6% growth).

- Austin's seasonally adjusted unemployment rate is 2.9%, up from 2.8% in July.

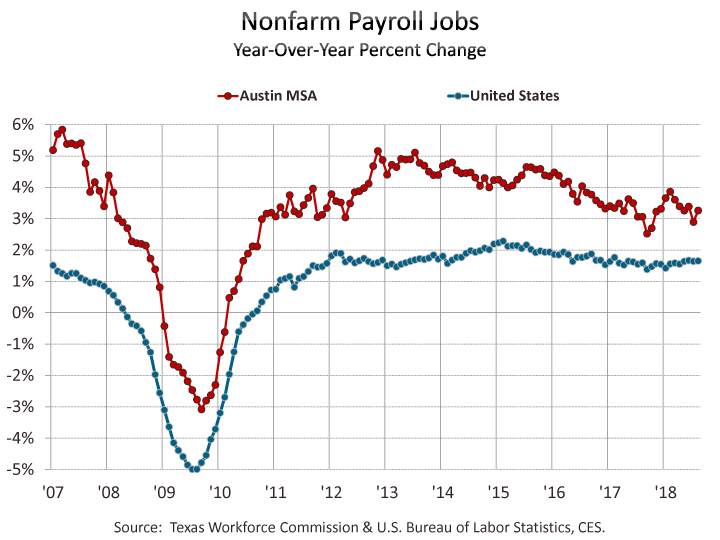

The Austin metropolitan area added 33,600 net new jobs, or 3.3%, in the 12 months ending in August, according to Friday's releases of preliminary payroll jobs numbers by the Texas Workforce Commission (TWC) and the U.S. Bureau of Labor Statistics (BLS).

Austin’s 3.3% growth makes it the eighth best performing among the 50 largest metro areas. Houston and Dallas, up 3.7% and 3.6% respectively, also made the top ten. Fort Worth (up 2.3%) and San Antonio (up 1.2%) ranked 18th and 37th.

For the year ending in August, private sector growth in the Austin MSA is 4.1%, or 35,400 jobs, with all private industry divisions, except education and health services, adding jobs. Austin's sizable government sector (over 17% of jobs) contracted over the last 12 months, losing 1,800 jobs or 1.1%, thus bringing the overall growth rate to 3.3%. It may be noted that in a ranking of the top 50 metros based on private sector growth, Austin’s 4.1% growth would put it in a two-way tie for third fastest growing.[1]

Texas saw net private sector job growth of 3.7% with all private industries, except information, adding jobs over the last 12 months. Total job growth was 3.2% as the government sector, which accounts for 16% of total state employment, was up by only 0.2%. For the nation, private sector growth is 1.9% for the 12 months ending in August with all private industries, except information, adding jobs. Overall job growth is a more modest 1.7% because of very minor (0.2%) government sector growth.

Jobs in August are up from the preceding month by 3,900 jobs or 0.4% in the not-seasonally-adjusted series for Austin. In the seasonally adjusted series, jobs grew from July to August by 4,800 jobs or 0.5%. Seasonally adjusted jobs are up by 0.4% in Houston, 0.3% in Dallas, 0.1% in Fort Worth, and unchanged in San Antonio. Statewide, seasonally adjusted jobs are up 3,200 or 0.3%. Nationally, seasonally adjusted jobs are up 0.1% from July.

In Austin, the industry adding the most jobs is professional and business services which grew by 9,900 jobs (5.6%) over the last 12 months. The fastest growing industry is wholesale trade, which grew by 13.3% (6,900 jobs). Also growing at faster-than-average rates are construction and natural resources (7.7% or 4,800 jobs); leisure and hospitality (7.5% or 9,500 jobs); and other services (5.7% or 2,600 jobs). Education and health services jobs declined by 1.6% or 1,900 jobs.Click here for graphs of the 2012-2018 growth rate trends for the major industry groups.

Statewide, construction and natural resources grew fastest, at 9.7%, and created 91,500 jobs. Professional and business services added the most jobs, 99,500, while growing 5.9% over the last 12 months. The other relatively fast growing industries were wholesale trade (up 4.8%) and transportation, warehousing and utilities (4.0%). Jobs declined in information by 3.0%.

Nationally, construction and natural resources grew fastest, adding 4.4% over the 12 months ending in August. Transportation, warehousing, and utilities (2.9%) and professional and business services (2.6%) were also relatively fast growing. Information jobs fell by 0.8%.

The net gain for private service-providing industries in Austin is 30,600 jobs, or 4.1%, over the last 12 months. Employment in goods producing industries is up by 4,800 jobs or 4.0%. Statewide, private service-providing industries are up 267,700, or 3.1%, and goods producing industries are up 114,600 jobs, or 6.4%.

We also now have August labor force, employment, and unemployment numbers for Texas and local areas in Texas. The same data for all U.S. metros will not be released until October 3. In July, Austin had the fifth lowest rate of unemployment among the 50 largest metros.

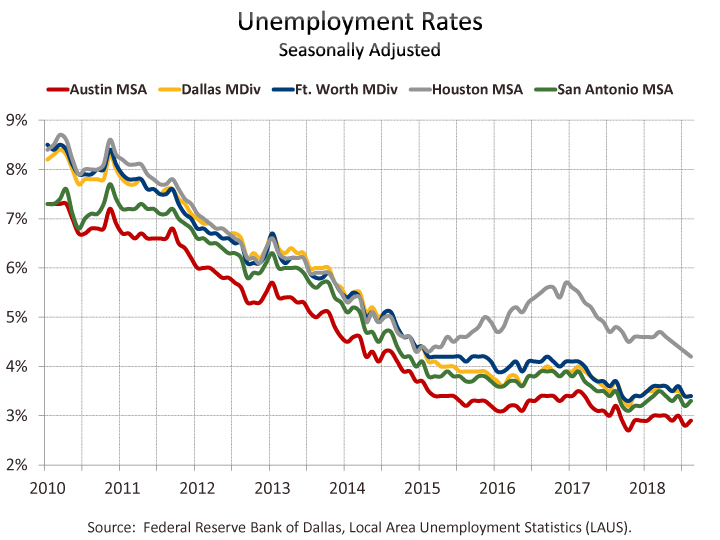

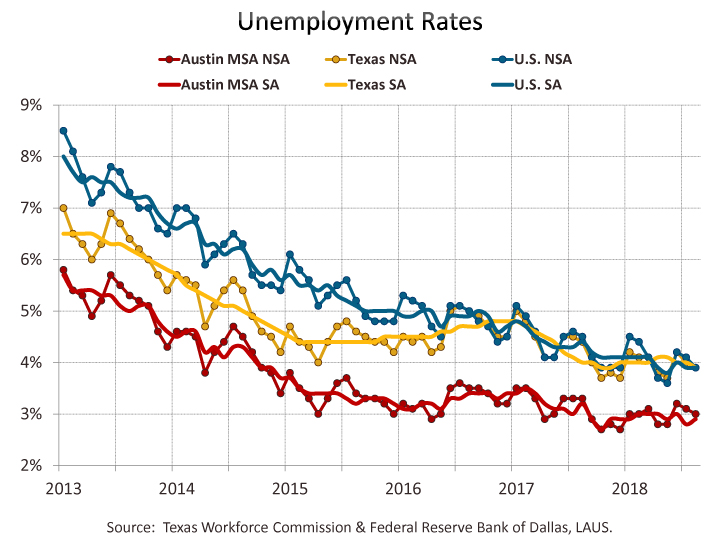

Unemployment numbers for August show Austin’s performance relative to the state and other major Texas metros being sustained. In August, Austin is at 3.0%, while the other major metros range from 3.6% in Fort Worth to 4.3% in Houston. Dallas and San Antonio are at 3.5%. Austin’s rate one year ago was 3.3%. The rates in Texas’ other major metros are also each below the rates seen a year ago. The statewide not-seasonally-adjusted rate is now 3.9%, down from 4.4% in August of last year. The national unemployment rate is 3.9%, improved from 4.5% in August 2017.

Within the Austin MSA, Travis County has the lowest unemployment rate in August, at 2.9%, while Caldwell County has the highest at 3.8%. The rate is 3.2% in Hays and Williamson Counties and 3.4% in Bastrop County.

On a seasonally adjusted basis, Austin’s August unemployment rate is 2.9%, up from 2.8% in July. The statewide seasonally adjusted rate is 3.9% in August, down from 4.0% in July, while the national rate is unchanged at 3.9%.

Among Texas’ major metros, San Antonio has the next lowest seasonally adjusted rate at 3.3%, Dallas and Fort Worth are at 3.4%, and Houston is at 4.2%. August rates are lower than July in Houston, higher in Austin and San Antonio, and unchanged in Dallas and Fort Worth. Seasonally adjusted unemployment rates for Texas metros are produced by the Federal Reserve Bank of Dallas. (The TWC also produces seasonally adjusted rates for Texas metros, but publication lags the Dallas Fed’s data.)

With the decrease in Austin’s unemployment rate from one year ago, the number unemployed has also declined. In August 2017, Austin’s number of unemployed was 37,898. Over the last 12 months, the unemployed have decreased by 2,109, or 5.6%, to 35,789.

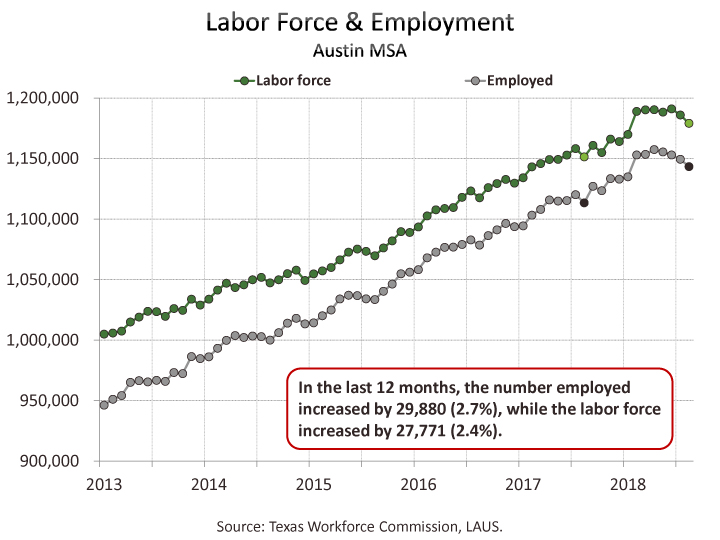

The Austin metro’s civilian labor force (employed plus unemployed) has increased by 2.4% or 27,771 persons from one year ago, while persons employed increased by 2.7% or 29,880. Texas has also seen greater growth in employed (2.2%) than labor force (1.7%), and the number unemployed decreased by 61,612 or 10.3%. Nationally, August civilian labor force is up by 0.7%, while employed is above the level of a year ago by 1.3%, and 917,000 fewer people (12.6%) are unemployed. Click here for graphs of the 2012-2018 growth rate trends for labor force and employment.

The TWC and the BLS will release September estimates on October 19.

The Chamber’s Economic Indicators page provides up-to-date historical spreadsheet versions of Austin, Texas and U.S. data for both the Current Employment Statistics (CES) and Local Area Unemployment Statistics (LAUS) data addressed above.

FOOTNOTE:

You may recall that Austin dropped just outside the top ten in the job growth ranking in our article about this data last month. Since Austin was sustaining relatively strong private sector growth, we took a closer look at the government jobs series which had been presenting negative year-over-year growth since last fall, after running consistently positive for the preceding five years.

Separate series for local, state and federal government employment are published for the Austin MSA. In examining these, it turns out that there has been a notable fall off in state government jobs (while federal and local government job growth has been positive). In 2017, jobs fell into a customary seasonal July-August trough, but instead of promptly rebounding, state government employment continued to hold at that level. This year, state government shed another 4,200 jobs in Austin between June and July, falling to 65,300, and then to 64,800 in August. This is the lowest state employment figure for the Austin MSA since August of 2006. In 2016, the metro's annual average state government employment was close to 75,000.

For Texas, state government detail is published for educational services (this subtotal is not reported for the Austin MSA by the CES survey). Statewide, government educational services growth has been positive, while year-over-year job growth has been negative for other state government functions since May 2017. This circumstance might point to the state government hiring freeze that was in effect from January through August of 2017 as potentially relevant to what has happened to state jobs. According to press reporting, while public universities were included in the freeze, positions not funded by state appropriations were exempt and only about 30% of money going to Texas’ public universities is state funding.

Therefore, state agency offices, rather than the metro’s state universities, may be where many of Austin’s state government jobs were shed from. Although the hiring freeze has ended, the state is in the challenging position of filling job openings while local private sector industries are expanding and unemployment is low. Click here for several graphs illustrating state government employment.

Related Categories: Central Texas Economy in Perspective