Job Growth & Unemployment

Posted on 03/29/2016 by Beverly Kerr

-

Austin added 39,800 net new jobs, growth of 4.2%, in the 12 months ending in February, making Austin the third fastest growing major metro.

-

Leisure and hospitality added the most jobs (8,600 or 7.8%) in the past year, however, the fastest growing industries are wholesale trade (9.6%) and construction and natural resources (8.4%).

-

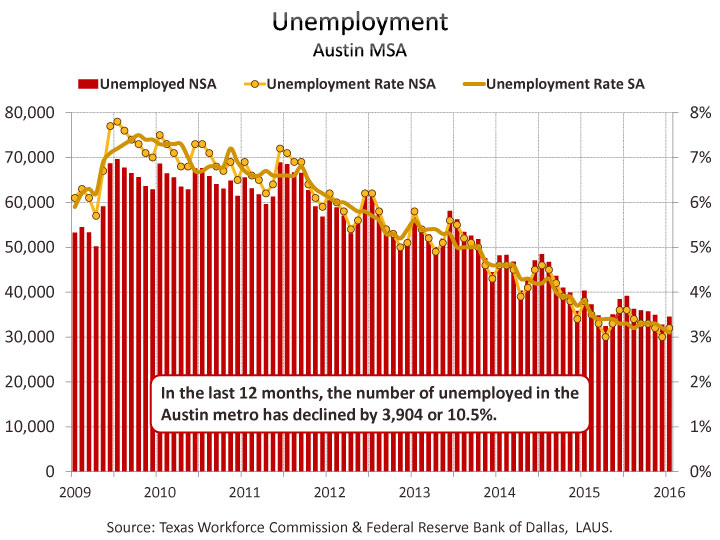

Austin's seasonally adjusted unemployment rate is 3.1%, unchanged from January.

-

The last time unemployment was as low as 3.1% was in February 2001, before the impact of the “dot com” recession.

The Austin metropolitan area added 39,800 net new jobs, or 4.2%, in the 12 months ending in February, according to Friday’s releases of preliminary payroll jobs numbers by the Texas Workforce Commission (TWC) and the U.S. Bureau of Labor Statistics (BLS). Austin’s 4.2% growth makes it the third best performing among the 50 largest metro areas. Dallas, at 4.5%, had the fastest growing job market. The other three major Texas metros missed the top 10. San Antonio grew by 2.6% (20th), Fort Worth grew by 1.1% (44th), and Houston grew by 0.3% (49th) between February 2015 and February 2016.

For the year ending in February, private sector job growth in the Austin MSA is 4.9%, or 37,700 jobs, and with all private industry divisions, but manufacturing, contributing to the growth. Austin's sizable government sector (nearly 18% of jobs) saw modest growth over the last 12 months, gaining 2,100 jobs or 1.2%, thus bringing the overall job growth rate to 4.2%.

Texas saw weaker net private sector job growth of 1.4% with all private industries, except two, adding jobs over the last 12 months. Since the government sector, which accounts for over 16% of total state employment, grew faster, 1.6%, total job growth statewide is 1.5%. For the nation, private sector growth is 2.2% for the 12 months ending in February, with all private industries adding jobs. Overall job growth is a more modest 1.9% because the government sector gained only 0.3%.

Jobs in February are up from January by 6,500 jobs or 0.7% in the not-seasonally-adjusted series for Austin, while on a seasonally adjusted basis, jobs are up by 1,000 or 0.1%. Seasonally adjusted jobs are also up in Dallas and in Fort Worth, by 0.5% and 0.2% respectively. Jobs are virtually unchanged in San Antonio and are down in Houston by 0.2%. Statewide, seasonally adjusted jobs are virtually unchanged (up 2,100 or 0.0%) in February. Nationally, seasonally adjusted jobs rose 0.2% in February.

In Austin, the industry adding the most jobs is leisure and hospitality which grew by 8,600 jobs, or 7.8%, over the last 12 months. Wholesale trade grew fastest at 9.6% (4,500 jobs), followed by construction and natural resources at 8.4% (4,500). Also growing at a faster-than-average rate is education and health services (5.2% or 5,700 jobs). Manufacturing lost 0.9% or 500 jobs.

Statewide, leisure and hospitality grew fastest (5.3%) and added the most jobs (63,500). The other relatively fast growing private industries were education and health services (4.1%), retail trade (3.0%), financial activities (2.3%), wholesale trade (2.2%), and other services (2.1%). Jobs in construction and natural resources declined by 44,100 (4.5%) and manufacturing lost 39,500 jobs (4.4%) over the last 12 months. The contraction of the construction and natural resources sector was driven by natural resources industries (down 56,100 jobs or 18.6%). The construction industry added jobs (12,000 or 1.8%). Texas’ manufacturing losses were concentrated in two durable goods industries—machinery and fabricated metal products manufacturing.

Nationally, professional and business services and educational and health services grew fastest, both adding 3.2% over the 12 months ending in February. Leisure and hospitality and retail trade also grew at faster-than-average rates, 3.0% and 2.3% respectively. Manufacturing saw the lowest rate of private industry growth, 0.2%. No industry lost jobs.

The net gain for private service-providing industries in Austin is 33,700 jobs, or 5.2%, over the last 12 months. Employment in goods producing industries is up by 4,000 jobs or 3.6%. Statewide, private service-providing industries are up 225,800 or 2.8%, but goods producing industries are down 83,600 jobs or -4.5%.

We also now have February labor force, employment, and unemployment numbers for Texas and local areas in Texas. The same data for all U.S. metros that we often do a ranking of will not be released until April 6. In January, Austin had the second lowest rate of unemployment among the 50 largest metros.

Unemployment numbers for February show Austin’s performance relative to the state and other major Texas metros being sustained. In February, Austin is at 3.1%, while the other major metros range from 3.5% in San Antonio to 4.7% in Houston. Dallas and Fort Worth are at 3.6% and 3.9% respectively. Austin’s rate one year ago was 3.5%. The rates in Texas’ other major metros are also improved from the rates seen a year ago, except for Houston, which has seen its unemployment rate increase (from 4.4%). The statewide not-seasonally-adjusted rate is now 4.3%, down from 4.4% in February of last year. The U.S. unemployment rate is 5.2%, compared to 5.8% in February 2015.

In 2007, before the impact of the Great Recession, unemployment averaged 3.6% in Austin, 4.3% in Texas, and 4.6% nationally. Unemployment has been below pre-recession levels for over a year in Austin. Texas’ February unemployment rate has met the rate averaged in 2007, while the nation, with unemployment at 5.2%, remains with a gap to bridge in regaining its pre-recession level of unemployment.

Within the Austin MSA, Travis County has the lowest unemployment rate in February, at 3.0%, while Caldwell County has the highest at 4.1%. The rate is 3.1% in Williamson County, 3.2% in Hays County, and 3.5% in Bastrop County.

On a seasonally adjusted basis, Austin’s February unemployment rate is 3.1%, unchanged from January. Rates have been 3.3% or lower since June. Austin has not seen unemployment this low since early 2001, before the “dot-com” recession. The statewide rate is 4.4%, improved from 4.5% in January. Nationally, the seasonally adjusted unemployment rate is 4.9%, unchanged from January.

Among Texas major metros, Dallas and San Antonio has the next lowest seasonally adjusted rate at 3.6%, while Fort Worth and Houston are at 3.9% and 4.7% respectively. February rates are unchanged from January in each metro, except Dallas which is improved by 0.1. Seasonally adjusted unemployment rates for Texas metros are produced by the Federal Reserve Bank of Dallas. (The TWC also produces seasonally adjusted rates for Texas metros, but publication lags the Dallas Fed’s data.)

With Austin’s unemployment rate down from one year ago, the number unemployed has also declined. In February 2015, Austin’s number of unemployed was 37,234. Over the last 12 months, the unemployed have decreased by 3,904 or 10.5%, to 33,330. The number of unemployed in Austin averaged more than 60,000 for three years running during the Great Recession.

The Austin metro’s civilian labor force (employed plus unemployed) has increased by 3.7% or 38,626 persons from one year ago, while persons employed increased by 4.2% or 42,530. Texas saw 1.7% growth in labor force and 1.9% in employed, while the number unemployed declined by 2.0%. Nationally, February civilian labor force is up by 1.3%, while employed is above the level of a year ago by 2.0%, and 876,000 fewer people (9.6%) are unemployed.

Texas Workforce Commission will release March estimates on April 15.

The Chamber’s Economic Indicators page provides up-to-date historical spreadsheet versions of Austin, Texas and U.S. data for both the Current Employment Statistics (CES) and Local Area Unemployment Statistics (LAUS) data addressed above.

Related Categories: Central Texas Economy in Perspective