Job growth & unemployment

Sign up for the Central Texas Economy Report newsletter

For opportunities with Austin employers currently hiring, see the Chamber's Austin Job Opportunities page.

Posted on 03/16/2021 by Beverly Kerr

- Adding jobs in 8 of the last 9 months, Austin has regained 71% of March and April’s pandemic-related job losses.

- Austin’s 2.7% year-over-year job loss is more moderate than the declines seen in all but two other major metros.

- Although growth was negative in December and January, Austin’s leisure and hospitality industry has seen 51% of the 61,500 jobs lost in March and April return.

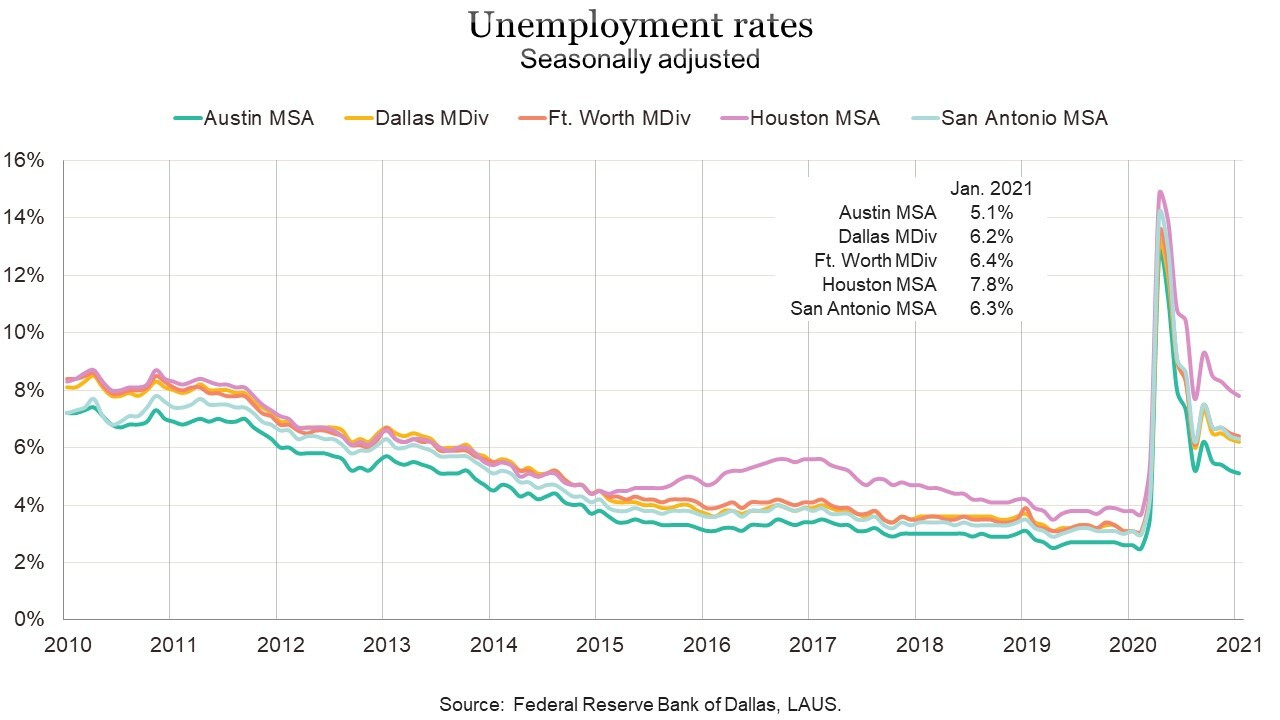

- Austin's seasonally adjusted unemployment rate decreased from 5.2% in December to 5.1% in January.

Nonfarm payroll jobs

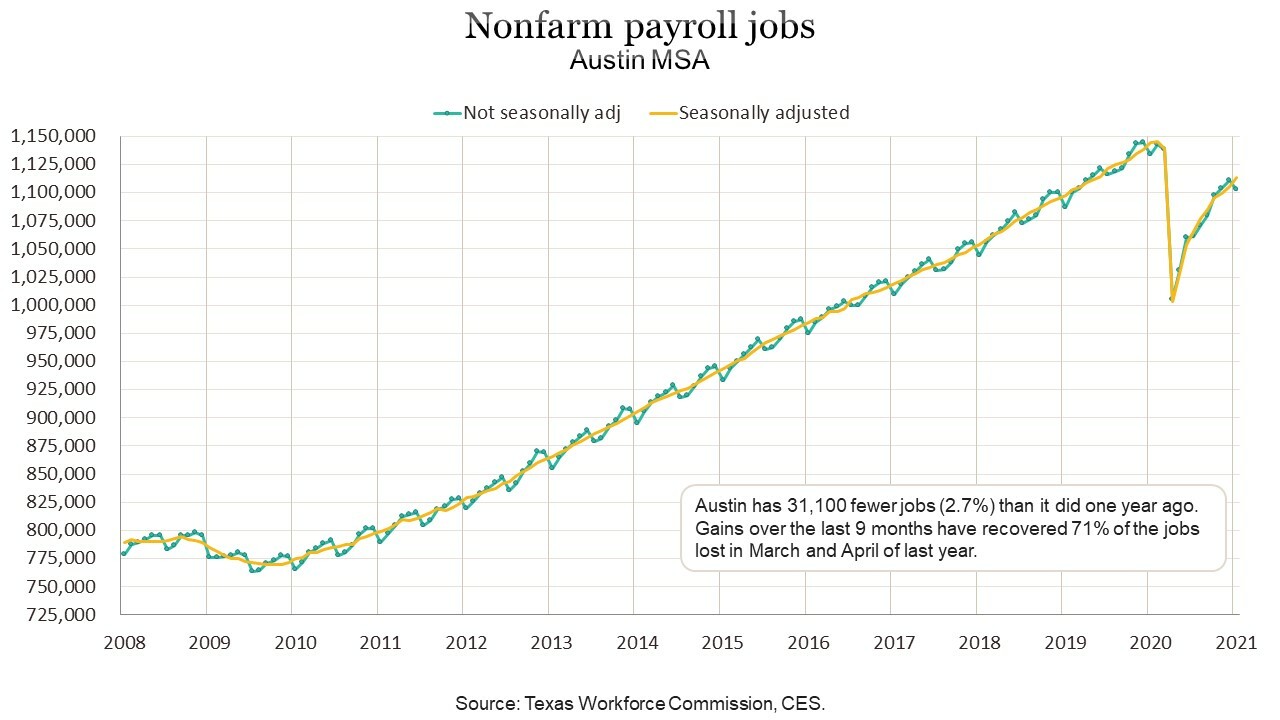

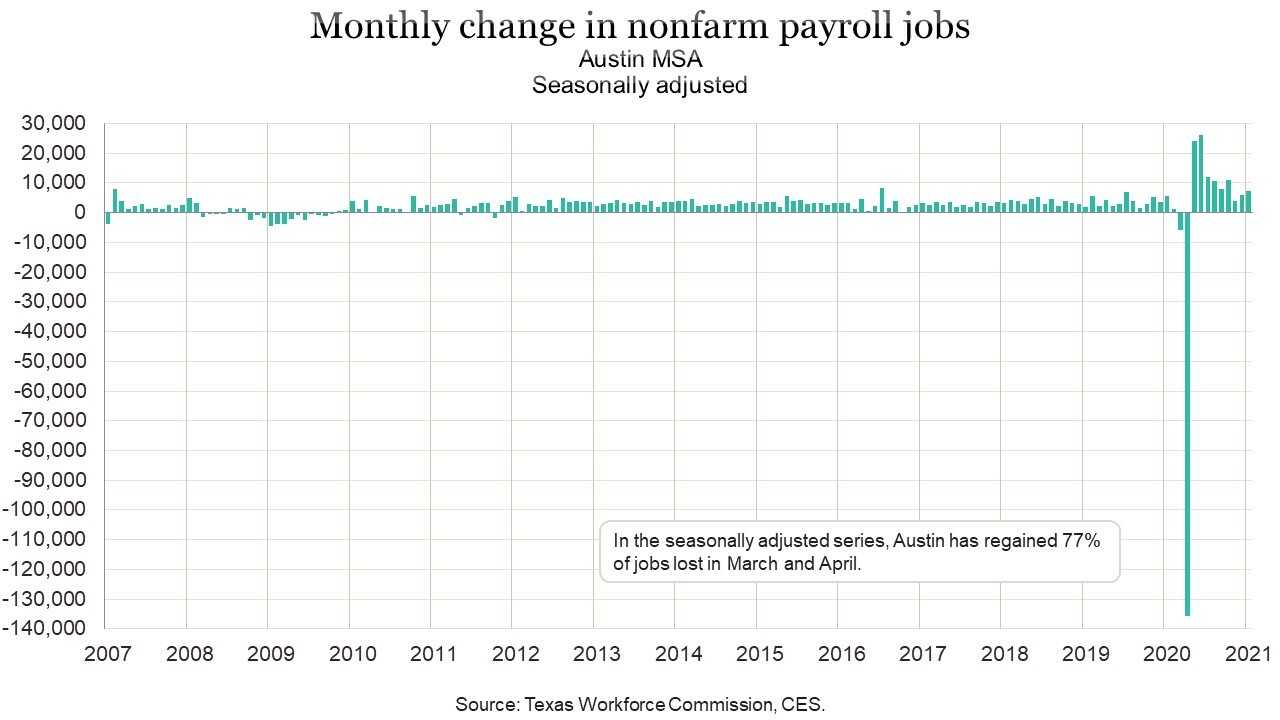

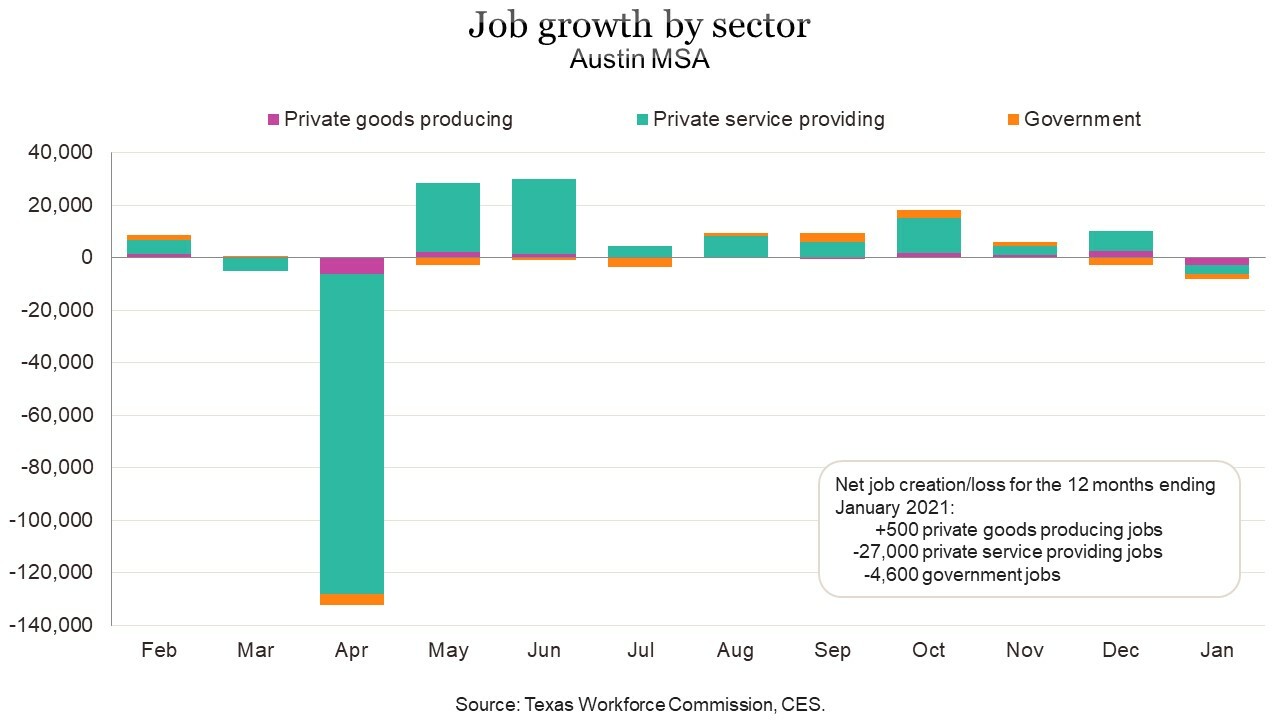

The Austin metropolitan area lost 8,200 jobs, or 0.7%, in January according to Friday's releases of preliminary Current Employment Statistics (CES) payroll jobs numbers by the Texas Workforce Commission (TWC) and the U.S. Bureau of Labor Statistics (BLS). In the not seasonally adjusted series, January jobs are normally lower than in December. Adjusted for seasonality, growth was positive over the month.

Austin’s nonfarm payroll jobs total as of January is 1,102,800. In February, before the impacts from COVID-19, Austin had an estimated 1,142,800 jobs. Combining job losses for March and April, Austin lost 137,000 jobs, or 12.0%. Positive growth in eight of the last nine months has brought back 97,400, or 71.1%, of those jobs.

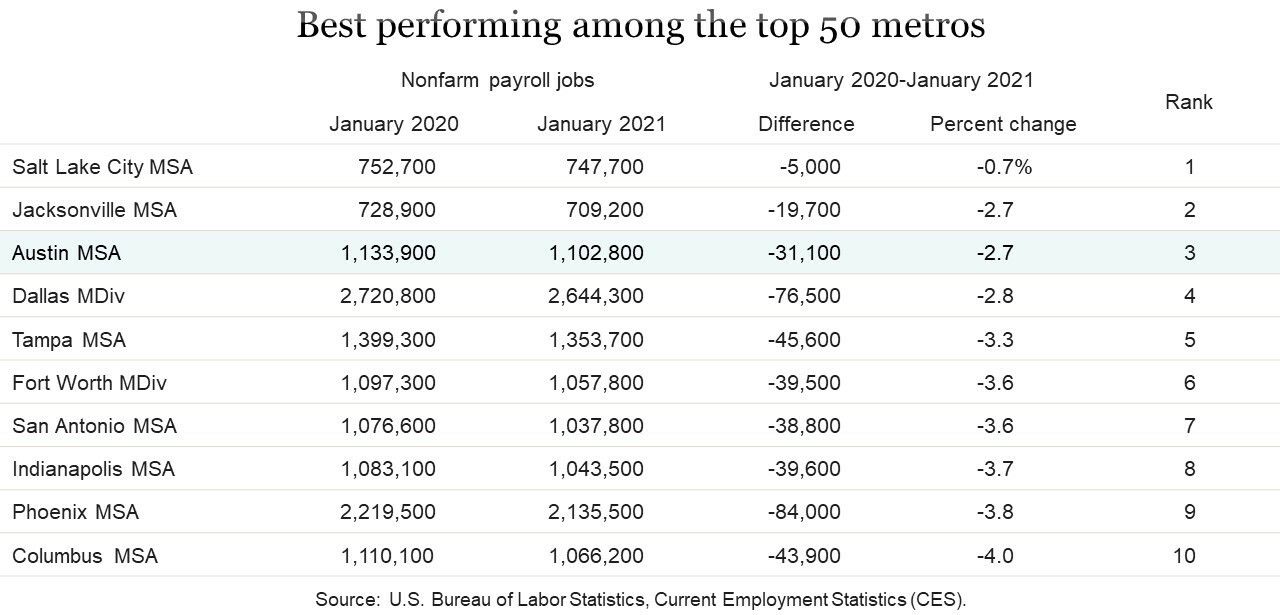

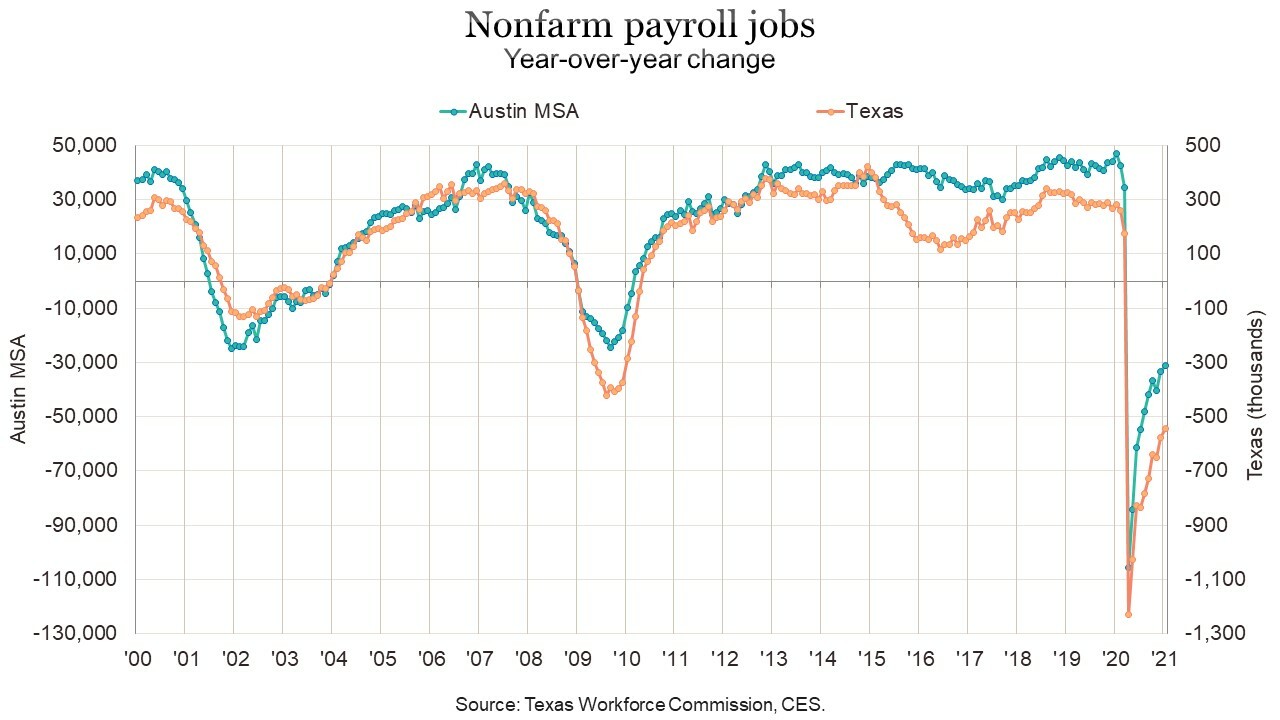

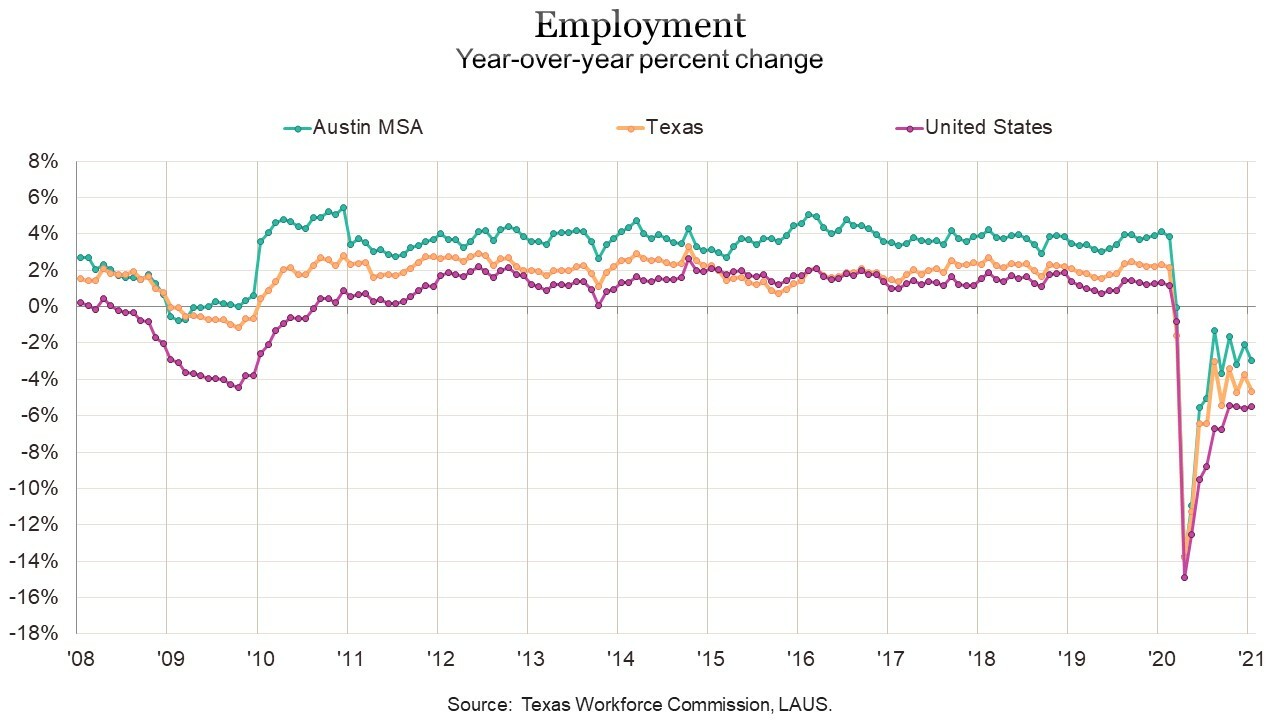

Austin’s year-over-year decline of 2.7%, or 31,100 jobs, makes it the third best performing among the 50 largest metro areas. Dallas, Fort Worth, and San Antonio also ranked in the top 10. Houston’s loss of 6.8% ranks 25th. Four major metros—Las Vegas, San Francisco, Orlando, and Los Angeles—remain down by more than 12% compared to January 2020.

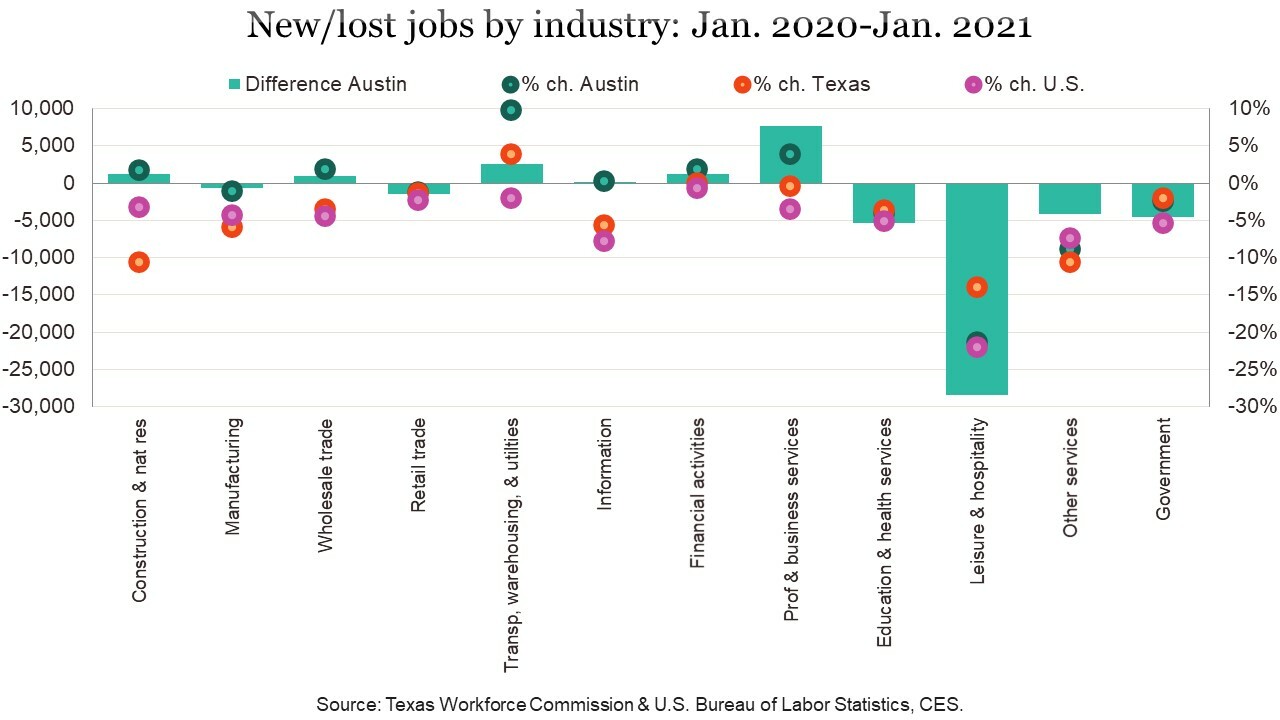

For the year ending in January, private sector job loss in the Austin MSA is 2.8%, or 26,500 jobs, with losses occurring in five of the 11 major private industry sectors. Total job losses were 2.7% because Austin's sizable government sector (17% of jobs) shrank by a slightly more moderate 2.4% or 4,600 jobs.

Texas saw net private sector job losses of 4.6% with all but one private industry sector losing jobs over the last 12 months. Total job losses were 4.2% as the government sector, which accounts for 15% of total state employment, had slighter losses (2.1%). For the nation, private sector losses were 6.2% for the 12 months ending in January with all private industries losing jobs. Overall job loss was 6.1% as government sector’s losses were relatively moderate (5.4%).

Jobs in January are down by 8,200 jobs or 0.7% from December in the not-seasonally-adjusted series for Austin. In the seasonally adjusted series, jobs increased by 7,300 or 0.7%. Seasonally adjusted jobs are up by 0.4% in Dallas and 0.1% in Houston. San Antonio is unchanged and Fort Worth jobs fell by 0.2%. Statewide, seasonally adjusted jobs are up 30,800 or 0.2%. Nationally, seasonally adjusted jobs are down from December by 166,000 or 0.1%.

In Austin, six private industry sectors have positive growth over the last 12 months, most notably transportation and warehousing (9.7% or 2,500), professional and business services (3.8% or 7,600), wholesale trade (1.9% or 1,000 jobs), followed by financial activities (1.8% or 1,200), and construction (1.7% or 1,200).

The greatest number of job losses, and greatest percent change, over the last year happened in leisure and hospitality (21.4% or 28,400 jobs). Other services saw an 8.9% decline (4,200 jobs) and education and health services is also notably down (4.1% or 5,400).

Leisure and hospitality shed 61,500 jobs in March and April (45% of all jobs lost). With positive growth in six of the last nine months, the industry has regained 31,300 of those jobs (32% of all jobs added over May through January). As of January, employment stands at 104,100. The last time Austin’s leisure and hospitality industry had a similar level of employment was early 2014. [1]

Statewide, over the last 12 months, only one industry added jobs. Transportation, warehousing, and utilities is up 3.8%. Financial activities and professional and business services are very close to last January’s employment levels. Double-digit losses prevail in leisure and hospitality (14.1% or 192,500 jobs), construction and natural resources (10.6%), and other services (10.6%).

Nationally, no industries added jobs over the 12 months ending in January. The largest percent change occurred in leisure and hospitality (22.0% or 3.59 million jobs), followed by information (7.8%), and other services (7.5%). Financial activities is the best recovered industry, with jobs only 0.7% lower than they were a year ago.

Over the last 12 months, the net loss for private service-providing industries in Austin is 27,000 jobs, or 3.3%. Employment in goods producing industries is up by 500 jobs or 0.4%. Statewide, private service-providing industries are down 341,600 or 3.8%, and goods producing industries are down 160,200, or 8.4%.

You may note that the magnitude of year-over-year changes are significantly different than figures indicated in the previous release of data through December. March is the occasion for annual benchmark revisions to nonfarm payroll jobs data. Preliminary estimates are made based on a sample survey of employers in the region. Annual revisions incorporate data from the Quarterly Census of Employment and Wages (QCEW), which is now available through the third quarter of 2020. Preliminary estimates showed Austin’s March/April pandemic-related job losses were 128,600 jobs, but revised estimates put the number at 137,000. Additionally, preliminary data had Austin regaining 128,600 jobs from May through December, but revised estimates reduce that gain to 105,600.

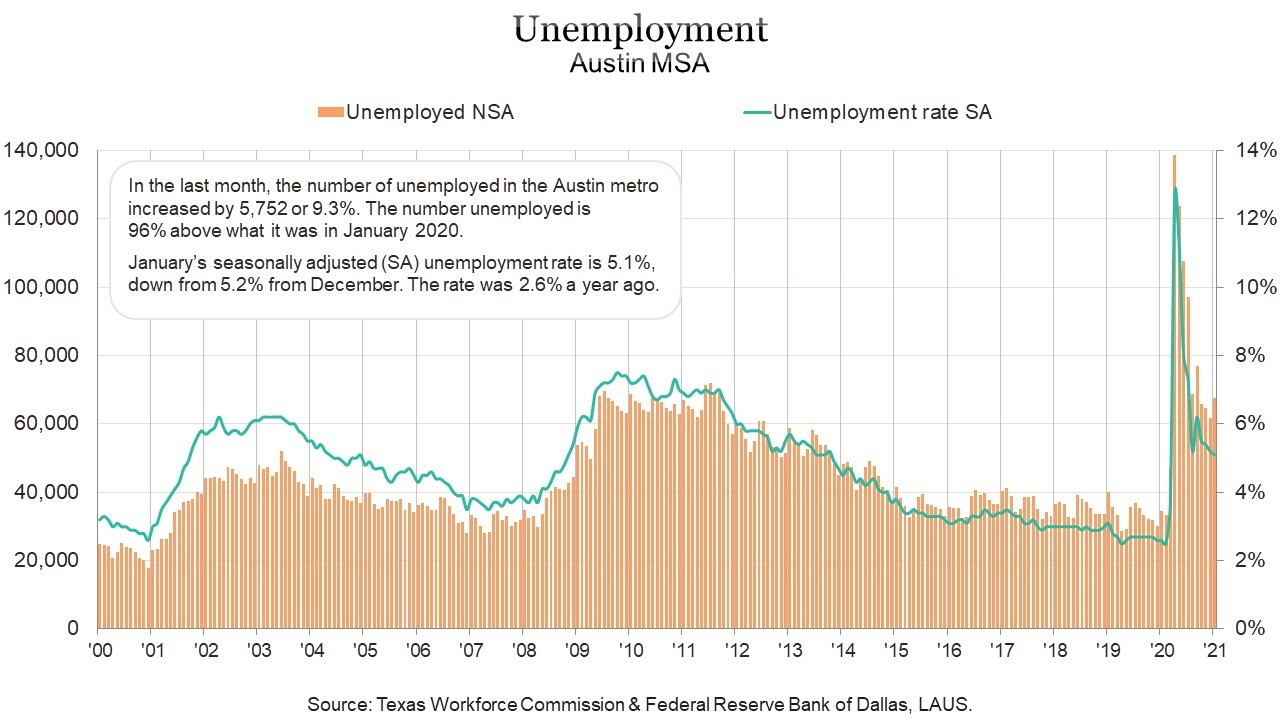

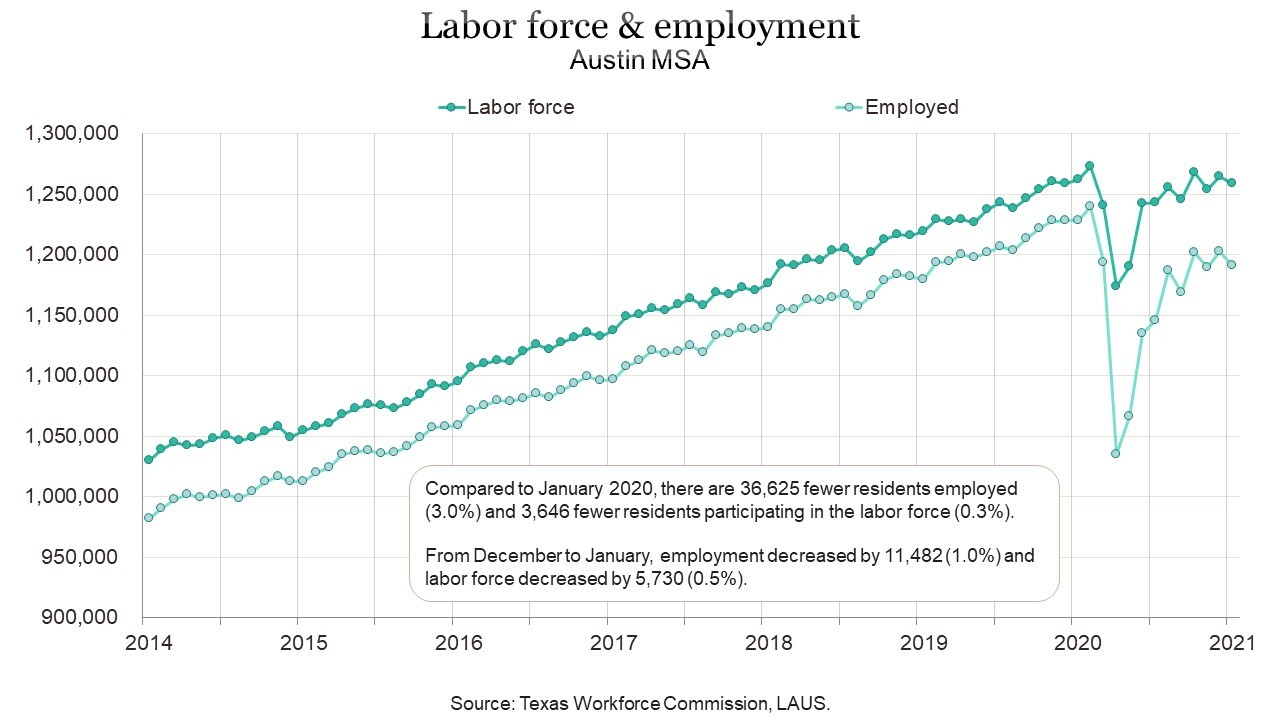

Labor force, employment & unemployment

We also now have January labor force, employment, and unemployment numbers for Texas and local areas in Texas. The same data for all U.S. metros will not be released until March 19. In December, Austin had the ninth lowest rate of unemployment among the 50 largest metros. Across Texas’ major metros, seasonally adjusted January rates are below December by 0.1 percentage points, except for Houston, which is down 0.2.

In January, Austin’s not-seasonally-adjusted unemployment rate is at 5.4%, while the other major Texas metros range from 6.4% in Dallas to 8.3% in Houston. San Antonio and Fort Worth are at 6.6% and 6.7% respectively. Austin’s rate one year ago was 2.7%. The rates in the other major Texas metros are elevated from a year ago by 3.1 to 4.2 percentage points. The statewide rate is now 7.3%, up from 3.7% in January of last year. The national unemployment rate is 6.8%, up from 4.0% a year ago.

Within the Austin MSA, Williamson County has the lowest unemployment rate at 5.2% in January, while Caldwell county has the highest at 6.2%. The rate is 5.4% in Travis County, 5.5% in Hays County, and 5.8% in Bastrop County.

On a seasonally adjusted basis, Austin’s January unemployment rate is 5.1%, down from 5.2% in December. The statewide rate is 6.8%, down from 6.9%, and the national rate is 6.3%, down from 6.7% in December.

In the aftermath of the dot-com bust, the highest seasonally adjusted unemployment rate reached in Austin was 6.1%. In the Great Recession, the highest rate was 7.5% and rates over 7% prevailed for 12 months.

Among Texas’ other major metros, Dallas has the next lowest seasonally adjusted unemployment rate, at 6.2%, in January, while San Antonio and Fort Worth are at 6.3% and 6.4% respectively. Houston’s rate is 7.8%. Seasonally adjusted unemployment rates for Texas metros are produced by the Federal Reserve Bank of Dallas. (The TWC also produces seasonally adjusted rates for Texas metros, but publication lags the Dallas Fed’s data.)

In January 2020, before pandemic impacts, the number unemployed in Austin was 34,476. The number climbed to 138,731 in April and also exceeded 100,000 in May and June. In January, unemployed stands at 67,455. That level is 96% above the level of one year ago.

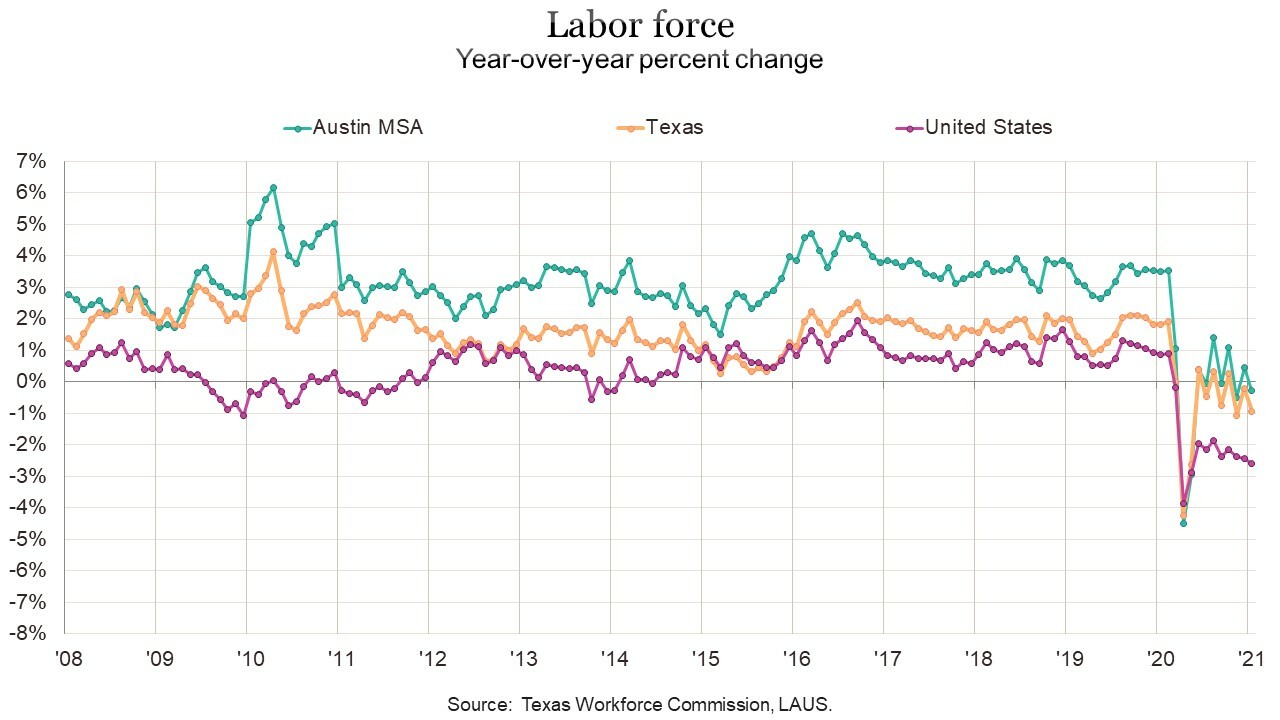

The Austin metro’s civilian labor force (employed plus unemployed) fell by 99,547 persons or 7.8% in March and April, while persons employed decreased by 204,971 or 16.5%. Labor force now stands at 0.3% below what it was a year ago and employed is estimated at 3.0% below.

Additional graphs – Labor force & employment: Texas and United States

Texas’ employment is 634,658 or 4.7% below last January, while labor force is lower by 133,335 or 0.9%. Thus, the number of unemployed increased by 501,323 or 95.2%. Nationally, January civilian labor force is down by 4.3 million or 2.6% year-over-year, while employed is below the level seen in January 2019 by 8.6 million or 5.5%, and 4.3 million more people (66.8%) are unemployed.

The TWC and the BLS will release February estimates on March 26.

The Chamber’s Economic Indicators page provides up-to-date historical spreadsheet versions of Austin, Texas and U.S. data for both the Current Employment Statistics (CES) and Local Area Unemployment Statistics (LAUS) data addressed above.

FOOTNOTE:

- Pre-pandemic, about 78% of Austin’s leisure and hospitality industry jobs were in food services and drinking places and, in January 2021, the share is 81%. Losses since February represent 19,900 jobs (19.1%) in food services and drinking places and 10,300 jobs (34.0%) in accommodation and the remainder of leisure and hospitality.↩

Related Categories: Central Texas Economy in Perspective