Venture Capital

Posted on 02/10/2017 by Beverly Kerr

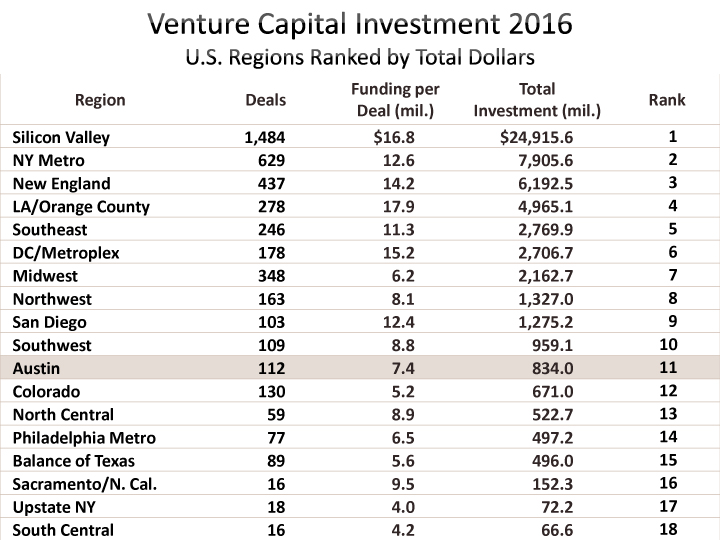

- Venture capital funding invested in Austin companies in 2016 totaled over $834 million.

- Austin’s 2016 deal count (112) is 7% lower than last year, however, activity fell by 16% nationally.

- Average investment per deal was $7.45 million in Austin, up from $7.10 million in 2015.

- Internet companies dominated VC investing in Austin, taking 54% of funding in 2016, compared to 38% nationally.

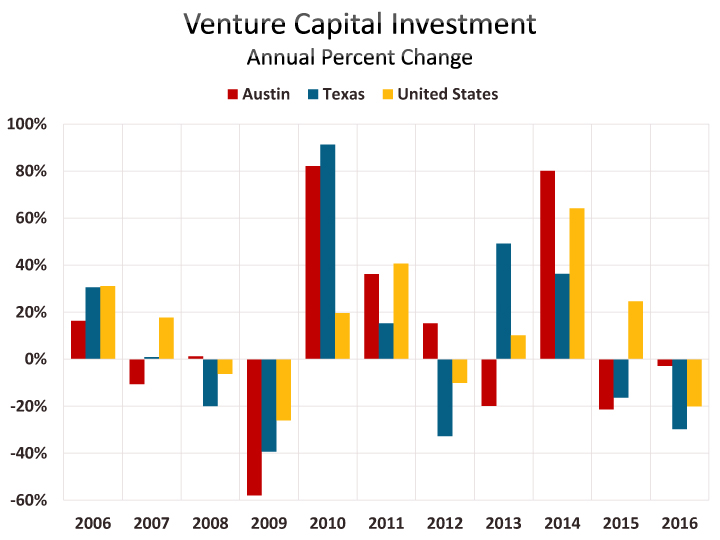

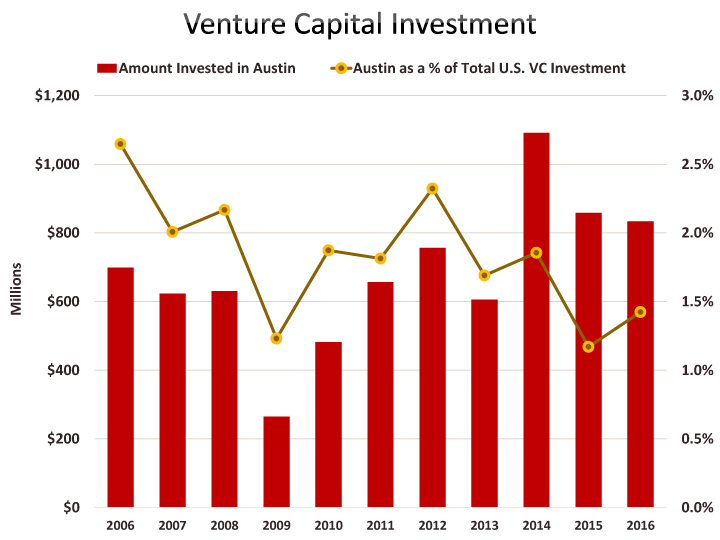

Austin companies attracted $834.03 million in venture capital (VC) investment 2016. That is 2.9% lower than 2015, but compared to the 20.1% fall in VC funding nationally, Austin faired relatively well in 2016.

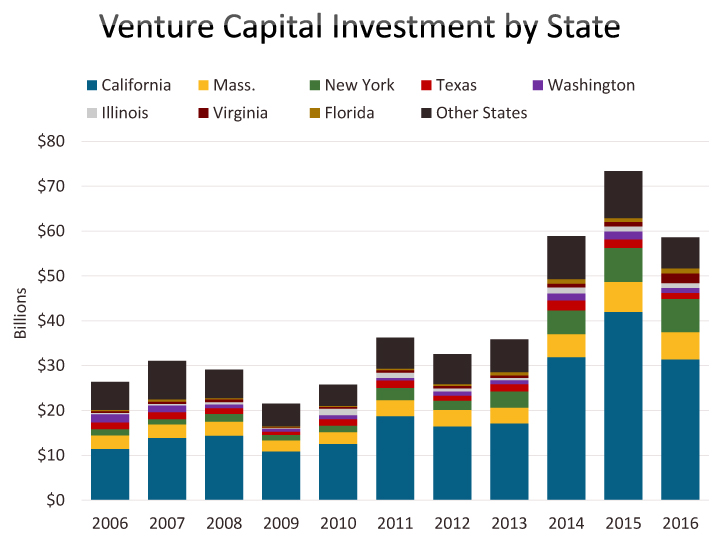

Austin’s 1.4% share of U.S. investing in 2016 is up from 1.2% in 2015, but below the 1.7% that Austin has accounted for over the last decade. Austin took the majority of VC investing in Texas in 2016—62.7%—considerably more than the 45.6% share Austin companies have seen over the last decade.

These numbers and those that follow are based on The PwC MoneyTree™ Report by PricewaterhouseCoopers and CB Insights.[1]

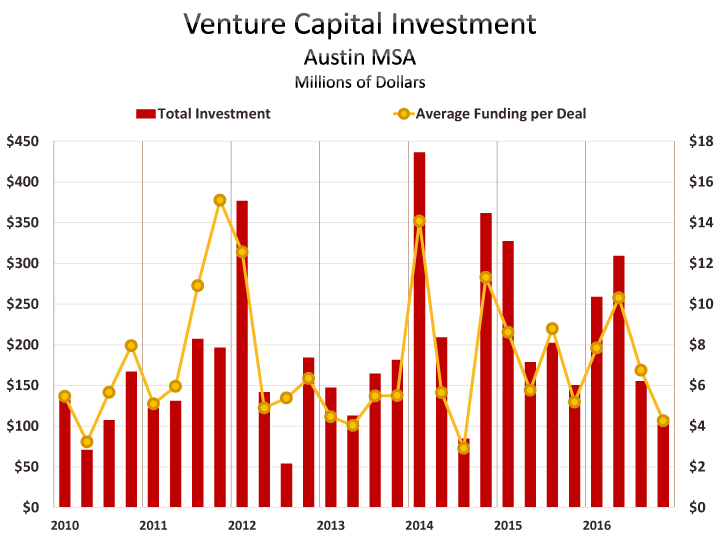

In 2016, 112 Austin companies took in an average of $7.45 million each. That level of funding per deal is higher than 2015 ($7.10), and also just above the average of the last decade ($7.40). However, Austin’s funding per deal is about 57% of the national average of $12.96 million in 2016. Over the last decade, average deal size in Austin has been 75% of average deal size nationally. For 2007-2011, Austin’s average deal size was 87% of the national average, and for 2012-2016, Austin’s average deal size was 69% of the national average.

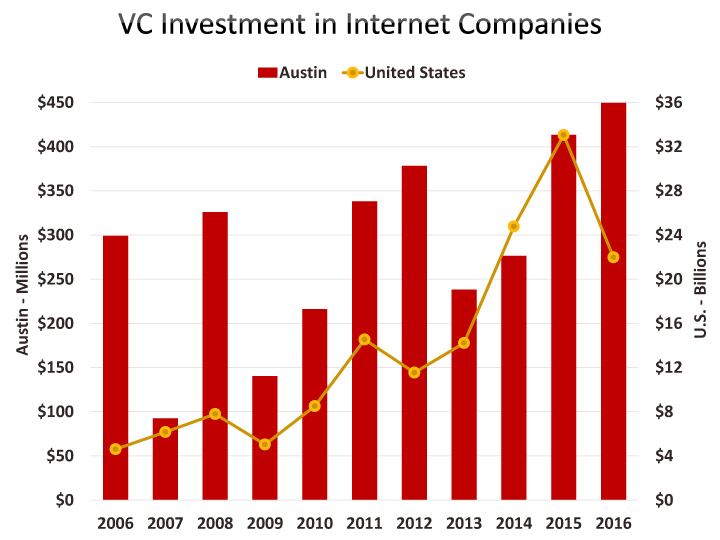

Internet companies took the majority of investments in Austin in 2016. Fifty-nine deals in this sector accounted for $449.5 million or 54% of total funding. PeopleAdmin, which provides cloud-based talent management solutions, collected $54.53 million, and Spreadfast, which provides a social media management platform, garnered a $50 million investment. These were the two largest deals in Austin in 2016. The next largest internet deal (and the seventh largest overall) was $30 million garnered by Big Commerce.

Healthcare was Austin’s second largest sector by value ($86.4 million) in 2016. Of the eight deals in healthcare, two of them were among the six largest of the year in Austin. Xeris Pharmaceuticals took $41 million and Lumos Pharma took $34 million.

The third largest deal of the year was $43 million going to Pivot 3, a company in the computer hardware and service sector. Another notable deal is $40 million which went to Open Lending. Open Lending provides automated lending services to financial institutions.

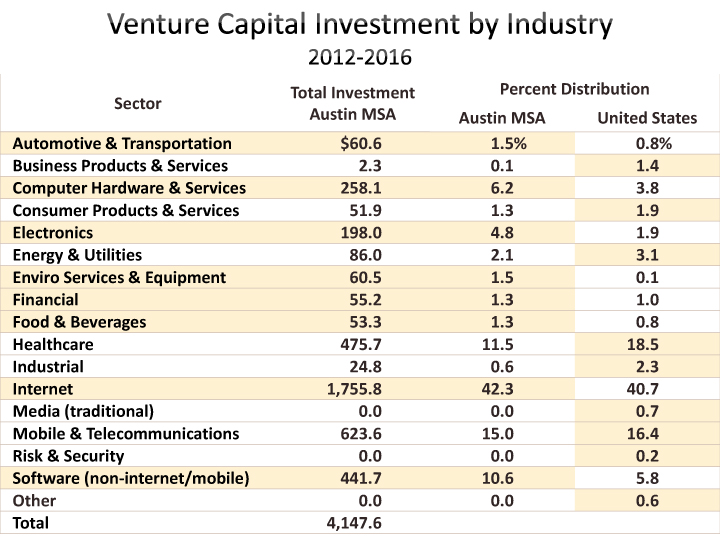

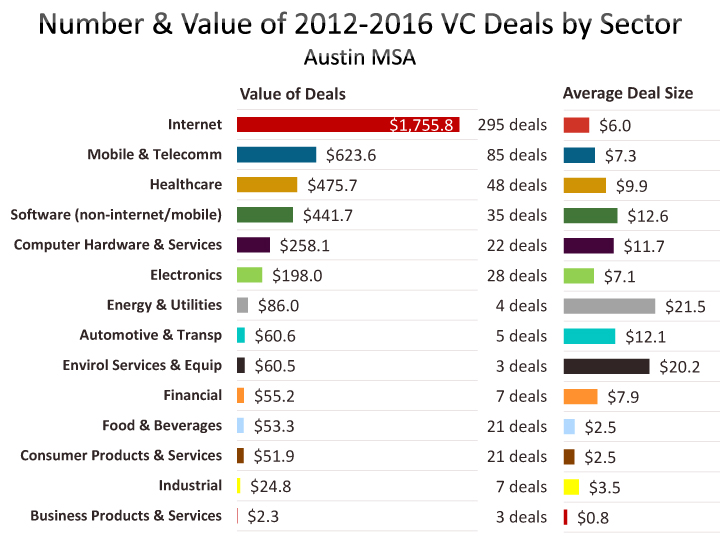

Internet companies dominate VC investing nationally as well as in Austin. Over the last five years, internet companies have attracted 42% of funding in Austin and 41% of funding nationally. In Austin, funding of internet companies rose 9% in 2016 and the sector accounted for 54% of the year’s investments. Nationally, funding of internet companies fell 33% in 2016 and the sector’s share contracted to 38%.

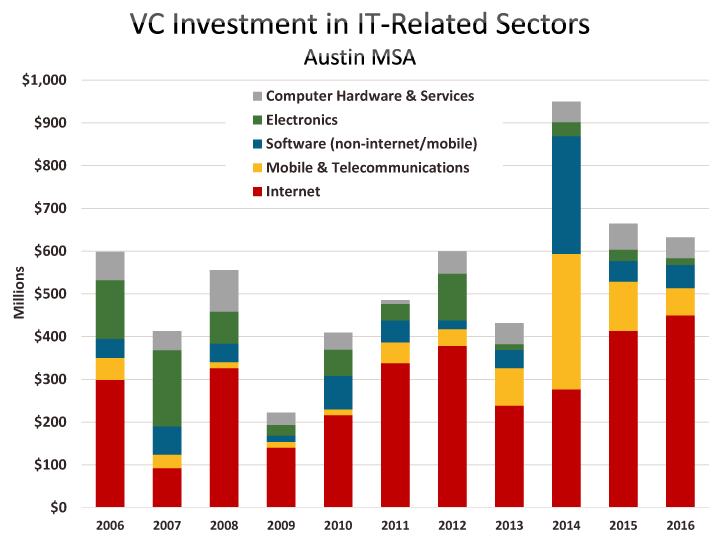

Together, the five IT-related sectors account for 79% of the value of investing in Austin companies over the last five years and 76% of 2016 VC dollars. Nationally, IT-related sectors account for 69% of 2012-2016 funding and 71% of 2016 funding.

VC investing in Texas has averaged 3.7% of total investment over the last decade. However, the state took in only 2.3% of the total in 2016, the lowest annual share since data begins in 1995. The last time the state represented more than 5% of U.S. funding was 2010.

Texas’ total investments of $1.33 billion in 2016 falls about 11% below the annual average of the last decade, while Austin saw 23% greater investment in 2016 than the annual average of the last decade. However, nationally, 2016 investment exceeds the decade’s annual average by 45%.

What probably most impacts both Austin’s and Texas’ contracted shares of total investment is the performance of California. California accounted for 43% of U.S. VC funding in 2006 but collected 54% in 2016. Silicon Valley takes the lion’s share of investing in California companies and its share of total U.S. VC funding was 30% in 2006 and stood at 43% in 2016. New York’s profile has also grown. The state accounts for 13% of VC funds in 2016, compared to 5% 10 years ago.

Investment in Austin companies over the last decade has been dominated by expansion stage company deals. However, in 2016, the value of expansion stage investing fell by 29% in Austin, while investing increased for each other stage of development class. Expansion stage companies garnered 41% of VC dollars over the last decade, but in 2016 these deals account for only 31% of funding. The average size of expansion stage deals was up in 2016, but the number of deals fell from 34 in 2015 to 21 in 2016.

Later stage investing rose 8% in 2016 and accounted for 35% of investing in Austin. That’s above the 31% that later stage has accounted for over the last decade.

Early and seed stage deals in Austin account for larger shares of investing in 2016 than has been characteristic over the last decade. The value of early stage deals was up 21% in 2016 and seed stage investment was up 50%. In 2016, 22% of investment was in 33 early stage deals (compared to 19% over the last decade) and 8% was in 31 seed stage deals (compared to 4% over the decade). Average deal size of seed stage deals was notably larger in 2016 ($2.09 million) than 2015 ($1.17 million). Virtuix (virtual reality hardware and classified in PwC’s consumer products and services sector) and Hangar Technology (software technology related to drones and aerial data) represent two of Austin’s most notable seed deals in 2016, attracting $7.7 million and $6.5 million respectively.

Nationally, 35% of 2016 investment is expansion stage and 36% is in later stage and those shares are close to the longer run shares (37% expansion stage/35% later stage). Early and seed stage investments are also similar in 2016 to the decade’s norms. Investment growth was negative in 2016 for each of these classes, most notably by 35% for later stage companies.

Over 100 VC firms invested in Austin companies in 2016. About a quarter of the firms participated in multiple deals. California accounted for the largest number of firms (42 firms, 9 of them in multiple deals), followed by Texas (19, 8 in multiple deals), and New York (14, 5 in multiple deals). Eight investing firms are based in other countries (China, France, Mexico, Spain, Taiwan, and the United Kingdom).

The Chamber’s Economic Indicators page provides an up-to-date historical spreadsheet of venture capital data for Austin, Texas and the U.S.

FOOTNOTE:

[1] For a detailed explanation of the investments represented in the PwC/CB Insights MoneyTree venture capital estimates, see page 44 of the U.S. MoneyTree Report. You may note that the MoneyTree report was formerly produced by PwC and the National Venture Capital Association with data from Thompson Reuters. With 2016, PwC and NVCA have separated. PwC’s new partner is CB Insights and NVCA is producing their own report, Venture Monitor with new partner PitchBook.

Related Categories: Central Texas Economy in Perspective